Over the past five decades, the American South has established itself as the go-to place in the United States for the biggest of big buffalo projects. In fact, the competition for large job-generating and investment deals in the South versus the other three U.S. regions isn’t even a competition. The South lands more big deals from the service and manufacturing sectors than any of the other U.S. regions by a large margin.

Over the past five decades, the American South has established itself as the go-to place in the United States for the biggest of big buffalo projects. In fact, the competition for large job-generating and investment deals in the South versus the other three U.S. regions isn’t even a competition. The South lands more big deals from the service and manufacturing sectors than any of the other U.S. regions by a large margin.

I recall being interviewed by a reporter with the San Antonio News Express when that market captured Toyota in 2003. It was a curious choice, a pickup truck plant going to South Texas where no automotive parts suppliers existed. The location was far from the spine of the Southern Automotive Corridor (which is Interstate 65) running from Alabama to Indiana. But the choice has sufficed, I guess. Not the best choice, but one Toyota must live with. Now Toyota is conducting another site search for their next “Big Kahuna,” and it looks like it’s down to two or three Southern states.

The newspaper reporter from San Antonio asked me in 2003, “Michael, is the South now ‘poised’ to become the largest economic region in the country?”

“Poised. . . poised, is that what you said?,” I responded. “Man, the South was poised to become this nation’s economic engine in the ’60s and ’70s.”

So, let me explain my statement. When I was born in the 1950s, the South, the Northeast and the Midwest each had about the same population — between 54 million and 56 million people. Today the Midwest and the Northeast’s populations are about the same at 63 million each. The South’s population has grown from 54 million 60 years ago to 126 million today, or about the same as the Midwest and the Northeast’s populations combined. The West has grown from 32 million people 60 years ago to 78 million today. You can’t have economic development without population growth, and the South’s growth is off the charts the last six decades, as is the West’s.

To accommodate those population increases, the West and the South dominate the capture of large economic development projects. Why? Most deals target areas where there are people. You can’t have a strong economic development resume without increases in population, especially today in the first lengthy period of full employment in 18 years.

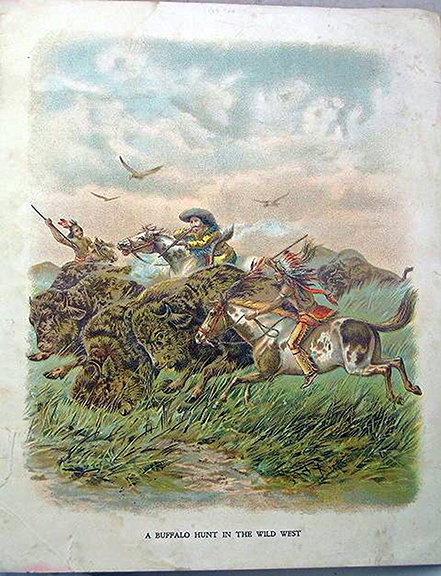

25 Years of Tracking Big Buffalo

Southern Business & Development is celebrating its 25th anniversary in the next four editions, and we thought we could start out profiling some of the largest buffaloes announced in the South in those 25 years.

The region has a history of landing colossal projects. Here are five older big buffaloes in the South that are still operating, and the year they began:

Other projects announced more than 25 years ago include UPS in Louisville, FedEx in Memphis, and automotive plants such as Toyota, GM in Texas or GM and Ford in Kentucky. Those facilities employ about 60,000 people in the South. And let’s not forget Nissan and GM in Tennessee, American Airlines’ relocation of its world headquarters to Fort Worth in 1979 or ExxonMobil’s headquarter relocation to Irving, Texas in 1989 and so many more.

Today’s Big Buffalo

There are some big buffaloes out there right now. In fact, the largest project—in terms of employment, anyway—I have ever heard of is still up for grabs and capture. Amazon’s second headquarters is far and away the largest single project seen in U.S. history with 40,000-plus jobs and a $5 billion investment. The investment is not the largest, certainly not compared to recent petrochemical and LNG complexes in Louisiana and Texas where a single project could cost $20 billion or more. Yet, Amazon’s employment figure is so fat it may be too much for any market to swallow in this first lengthy period of full employment seen in the United States since 1998 to 2000.

According to Amazon, the HQ2 project will be similar in scope to its Seattle headquarters. There, the company currently houses 40,000-plus workers in 33 buildings encompassing 8.1 million square feet. Last year alone, the number of hotel night stays in Seattle by visiting Amazon employees and business guests totaled 233,000. In addition to the 40,000-plus jobs, 53,000 additional jobs were created in the Seattle area from 2010 to 2016 as a result of Amazon’s direct investments.

By the October deadline set by Amazon, 238 proposals were accepted by the company from cities and regions in 54 states, provinces, districts and territories across North America. Let’s not forget that Amazon’s HQ2 is a second “North American” headquarters for the company, meaning it could be located anywhere on the continent, such as Toronto.

I am quite sure that no human being dislikes any other human being more than Amazon CEO Jeff Bezos’ dislikes President Trump and, apparently, the feeling is mutual. They don’t like each other at all. So, would the richest man in the world—not Trump, but Bezos—risk President Trump taking credit for landing Amazon’s HQ2 in New York, Boston, Denver, Austin, Atlanta, Charlotte or Dallas-Fort Worth? I have my doubts.

Bezos knows Canada is in play and he might play that card. However, Amazon won’t get a fair shake on the incentive package that 40,000-plus possible jobs over a decade or so could garner if Bezos places his second headquarters in Canada. Regardless, that’s my pick: Toronto. My second choice is the Gulch section of downtown Atlanta.

Thing is, Toronto is one of the few places in North America that has the labor necessary for a project such as Amazon’s HQ2, and meets or exceeds the criteria set forth by the company. And that’s a stretch. The Toronto MSA’s unemployment rate is over 5 percent.

There are a few other markets that might have the labor. Atlanta is certainly a possibility, so is Northern Virginia and New York City. But Boston’s unemployment rate right now is barely above 3 percent. Austin’s unemployment rate is at 2.6 percent and dropping. Anything less than 3 percent means people are working who don’t want to work. And that’s exactly Denver’s situation, where the unemployment rate is 2.2 percent as of September. How in the world could Amazon find more than 40,000 workers in a market with a 2.2 percent unemployment rate? They can’t.

Sure, lots of folks still move to Austin and Denver, but it’s not a sufficient yearly amount for Amazon’s HQ2. Austin and Denver are beyond full employment—the ultimate goal of any economy—and the two large MSAs’ project activity, which has been historically slow, suggests there is no labor left in either city. Dallas-Fort Worth’s labor availability is similarly nonexistent.

The Toyota-Mazda Project

The other big buffalo that’s out there right now is the joint, 50-50, $1.6 billion project between Mazda and Toyota, or so we are told. With a top-end of 4,000 jobs, this big buffalo is a little easier to manage in terms of workforce. I believe proving that an area can backfill 4,000 jobs 20 years from now, and that the area has a certified megasite, will make the difference in this big buffalo hunt. This site search will be all about labor availability in an area that is home to a certified megasite.

Additionally, I strongly believe that the Mazda and Toyota project will end up somewhere in the Southern Automotive Corridor. After all, there hasn’t been an automotive plant built outside of the Southern Auto Corridor in the U.S. since Honda announced in 2006 it picked Greensburg, Ind., to produce Honda Civics. Since then, the South has landed all four automotive plants announced and built in this country.

Some sources are saying that North Carolina is the frontrunner for Toyota and Mazda’s proposed $1.6 billion, 4,000-employee plant that the Japanese automakers are shopping around the U.S. The advantages are numerous for the Tar Heel State, sources say. They cite four excellent megasites in the state—two in Chatham County near the Research Triangle, one in Randolph County near Greensboro and another in Edgecombe County near Rocky Mount. North Carolina also has one of the largest workforces in the South in this age of very tight labor.

Also weighing in North Carolina’s favor, some say, is the fact that the state is not currently home to what we call a “Big Kahuna,” or a major automotive assembly plant. This would mean that Toyota’s powerful lobbying of the U.S. government would gain a new group of supporting politicos from the Tar Heel State.

Plain and simple, automotive plants are the Big Kahuna in economic development. No projects have the economic effect that an automotive plant has on a state, multi-county region or city, except for maybe the aforementioned Amazon HQ2. Simply put, automotive plants are the largest drivers of wages in the South. In 22 of the last 23 years, the automotive industry has led all sectors in the region—services or manufacturing—in large projects of 200 jobs or more.

North Carolina will have to pony up for the Toyota and Mazda joint venture, unlike it has ever done for a large job-generating deal. The largest incentive package I can recall that North Carolina has doled out over the last 25 years was to Dell when it opened a computer factory in Winston-Salem in 2005. That package totaled over $200 million. However, Dell didn’t even get a whiff of a good portion of that $200-plus million. The plant closed four years after opening and most of the incentives paid to Dell were returned to state and local agencies via clawback provisions.

North Carolina has allotted in its state budgets this year and next year up to $50 million in incentives toward a “transformative” project. According to the provision, that amount could be offered by the state for a project of $4 billion in capital investment and a 5,000-employee commitment. Let me tell you, it’s going to take a lot more than $50 million to land the Toyota-Mazda deal.

In fact, it might take a $1 billion incentive package or more to land the project, which reports say will be the most efficient automotive factory in the world, using artificial intelligence and connectivity to build automobiles. Toyota will most likely make electric Corolla models, and Mazda will make electric SUVs at the proposed plant.

But there is an issue I have discovered through reliable sources about the Toyota-Mazda project. Mazda has not been engaged in the project’s site search. I don’t know of a single economic developer in the South who has met with a Mazda exec. I have heard of several meetings with Toyota about the project. Either Mazda is letting Toyota’s site team pick the site, or Mazda is no longer a part of the deal.

As of deadline for this issue, several reports say the Toyota-Mazda site search is down to two states—Alabama and North Carolina. And it might be down to two sites—the megasite in Huntsville, Ala., which Volkswagen considered before choosing Chattanooga, and a site near Liberty, N.C., that Toyota looked at before choosing a location near Tupelo, Miss., for a plant.

The Last of the Big Buffalo?

At this fall’s 44th Annual South Carolina International Trade Conference in Charleston, S.C., I had an opportunity to speak with the noted economist Dr. Nariman Behravesh, the chief economist of IHS.

Dr. Behravesh is often quoted by just about every major media property worldwide, and is charged with developing the economic outlook and risk analysis for the United States, Europe, Japan, China and emerging markets.

Like all economists I talk to, I asked Dr. Behravesh what is the No. 1 issue in today’s domestic economy. According to Behravesh, the most important issue in today’s economy is worker productivity, or lack thereof. He has written and been quoted on the subject in numerous media outlets, saying, “The greatest challenge to the sustained long-term performance of the U.S. economy is the puzzling low growth of productivity, especially in light of the apparent explosion of new technologies.”

Yet, worker productivity improved dramatically in the summer quarter, boosting output per hour by 3 percent, the best rate in three years. Granted, worker productivity saw no gains during some quarters in 2014, 2015 and 2016, but so far in 2017, it has seen gains each quarter. I am no expert on worker productivity, and Behravesh is one of the most respected economists in the world, but I cannot imagine productivity being more important than our constrained labor pool right now.

Dr. Behravesh then asked me what I thought was the most pressing issue in today’s economy. I told him that we are running out of labor—if we haven’t run out already—and that the last time our unemployment rate was this low in the South was in the late 1990s and in 2000. In October, the South’s unemployment rate was 4.0 percent and the nation’s was 4.1 percent.

Instead of 4.0 percent, I believe the unemployment rate in the South is really something like 3.0 percent. As I mentioned, the last time we had an unemployment rate this low was in the late 1990s. Back then there were few drug tests given when applying for a job. Today, most job applicants are required to submit to a drug test. Since we are in the midst of what many are calling an opioid epidemic, who knows how many people are outside the workforce simply because they know they can’t pass a drug test.

In a recent study published by Princeton University, the increase in opioid prescriptions in the U.S. from 1999 to 2015 could account for about 20 percent of the observed decline in men’s labor force participation rates and 25 percent of women’s during the same period. That would mean the total number of people who know they can’t pass a drug test is in the millions, and they must be accounted for when discussing the unemployment rate and the available labor shed.

During the conversation I had with Dr. Behravesh, he agreed that the nation is labor poor and that it is going to get worse before it gets better. He cited that there is a pool of about 1.5 million people available in the U.S. who are suited for full-time jobs. Only 1.5 million workers available for full-time jobs in the entire country? That is frightening.

In October, the U.S. created 261,000 jobs. If we created that number of jobs each month going forward we would run out of labor in five months if Behravesh’s figure is correct and there is no sudden rash of mass layoffs. Currently, layoffs are increasing compared to the last three years, but certainly not in numbers to resupply our labor force at any measurable rate.

At the point of labor exhaustion, some serious poaching of existing workers would begin in earnest since there would be no labor shed available, and inflation, you would think, would surface quickly. It’s not happening yet, but next year is going to be a different economic development year compared to any year since the recession.

Neel Kashkari, President of the Minneapolis Federal Reserve, said in the spring of 2017 that we can do one of three things regarding the labor situation. (1) “We can accept slower growth.” (2) “We can subsidize fertility.” (3) “We can embrace immigration, and those are the three choices,” he said, “and that’s literally math and you can pick which one you like.”

The biggest problem the U.S. has with its labor shed is one based on demographics, not education, politics or workforce training. There is nothing political about a nation that is not growing. In 2017, population growth in the United States was 0.7 percent and it’s been below 1.0 percent since 2002. That phenomenon has really gashed into the total number of people turning working age (16 years old) in this country, and it will continue to do so for years to come.

For decades, the number of people entering the workforce in the U.S. (16 years old) on average was about 200,000 a month. The last three years have seen that drop to about 70,000 on average per month, a staggering loss of potential workers. Simply put, the United States is aging at an advancing rate and Millennials are not even close to matching the fertility rates seen from previous generations, such as Baby Boomers.

During my travels throughout the South, I make it a point to ask employers how difficult it is to find workers in today’s environment. One executive with Memphis-based International Paper told me it took him 18 months to find a C-suite manager. An owner of a trucking company said he cannot find drivers and that his immigrant employees are the best workers he has. The owner of a mid-sized manufacturing company in Tennessee told me about half of his prospective employees can’t pass the drug test his company gives. And farming, which uses a higher percentage of illegal labor than any other U.S. industry according to the Pew Research Center, is experiencing a labor crisis.

So, what do all of these facts about a labor shed that has gone bare tell us? Again, the Fed is telling us that we must “embrace immigration” or “accept slower growth.” Now, that’s when the situation morphs from simple demographics to highly charged politics. Yes, the immigration issue is a hot-button issue, but the labor situation isn’t politics, it’s demography.

We know how difficult it is to find skilled workers in this country. However, let’s put the skilled worker situation aside for the time being, because there is a much larger threat projecting forward from the unskilled set. Those include low-skilled factory workers, construction workers, restaurant workers, landscapers, farm workers and unskilled positions in healthcare, such as those who tend to seniors in retirement homes.

Today, we are restricting visas issued to foreign workers, cutting legal immigration, revoking DACA and increasing deportations of the undocumented. That’s politics. Immigration is a highly politicized federal issue.

However, that policy will clearly and in short order vaporize the small amount of labor we have left, endangering any chance of 4 percent GDP growth, possibly even slowing growth from today’s 3 percent to 1 percent within a year to 18 months. That’s not politics; again, that’s demography. It’s math.

Here is the labor situation looked at from a different angle. As of September, there were approximately 6.5 million people unemployed in this country and that includes anyone without a job between the ages of 16 and 65. Included in that group would be retirees under age 65, students in college and high school, family caretakers, the disabled, the mentally ill and the addicted.

There are approximately 6.1 million job openings as of October in the U.S., a near record. Do the math; there are many more job openings than there are people available for that work in the U.S., once groups who are unable to work are factored in. That’s where Dr. Behravesh came up with 1.5 million people available for full-time work in this country that was cited earlier in this article.

Without an increase in immigration and foreign worker visas, Mark Zandi, the chief economist at Moody’s Analytics in a recent article published by The New York Times, makes this prediction about our economy, “Our problem going forward isn’t going to be unemployment. Over the next 20 to 25 years, a labor shortage is going to put a binding constraint on growth,” Zandi was quoted as saying. He cited the number of Baby Boomers who will retire over the next 10 years and how difficult it will be to offset those retirements considering the slow rate at which the U.S. population is growing. As a result of Baby Boomer retirements, Zandi expects the labor force in the U.S. to actually decline within a few years. That hasn’t happened in decades.

The bottom line is that America needs more workers or the economy will slow down, it’s that simple. There is a list of things we can do to increase labor participation, which, at 63.1 percent as of September, is stuck between the all-time low of 60.4 percent in 1970 and the high of 67.1 percent in 1999. Improving access to high-quality education is the center of the issue, and persuading high school students to take the community college route would improve the situation, especially in the skilled set department. And the federal government, as well as state governments, must somehow get a handle on the over-prescribing of painkillers.

There is also a list of things not to do in an age of scarce labor. Restricting immigration is one of those things that we must not do. And now, with reshoring and “Made in America” actually being a real thing, passing legislation that will limit trade is also something you cannot do in a tight labor shed.

There has never been a time when more people around the world, particularly the Chinese, want American-made goods. In just 30 years, China’s economy has produced a middle class of 330 million people, essentially the entire population of the United States. The new-found middle class in China wants to purchase American goods. If trade is restricted, that opportunity will be missed.

Conclusion

It’s ironic that Amazon, the biggest buffalo project in U.S. history, is being shopped at a time when the availability of labor in this country is essentially gone and being attacked from so many sides by cuts in immigration and the threat of deportation of people born in this country. Could Amazon’s HQ2 and the Toyota-Mazda deals be the last of the big buffalo for quite some time? Only time will tell, but it’s going to be tough in the near future to convince site consultants that a particular community in the South can backfill 3,000 or more jobs for a single project 20 years from now. The last of the big buffalo may be upon us.