There are a number of challenges currently facing our economy in addition to the coronavirus. These challenges, at least for now, are different than the housing crisis that began in some states like Florida as early as 2005. By 2008, lenders — even those like Lehman Brothers, which was founded in the mid-1800s — went bankrupt as the bubble burst. In other words, the last recession was based on a lack of liquidity. This, the Coronavirus Recession, is different.

Since the onset of the coronavirus, millions of jobs have been lost and there are financial issues we really don’t even know about as of yet. We do know that the virus has snuffed out millions, if not tens of millions, of jobs and experts are saying that the unemployment rate as a result of this virus could run up to 15 to 30 percent. In other words, a total disaster never experienced by this country.

Matthew Phillips, a wonderful reporter with CNN (he is an assistant news editor, always the hardest working ones and real journalists) emailed me in April, “Hi Michael, it’s been a while since we last talked. Wanted to see if you had a minute to catch up later today. Interested to chat about the effect the virus is having on Southeast manufacturers, what you’re hearing and seeing from clients, etc.”

I called Matthew back (he was covering the Trump afternoon virus show) and then texted him: “Hi Matthew, good to hear from you again. Here is the deal: Seventy-five percent of everything in the South’s economy is closed. Nationwide, coronavirus job losses, by my count, could total 50 million by summer, unemployment rate may hit 20 percent from 3.5 percent in a year, if not higher. Matthew, if you need anything else, just call me tonight. I am in deadline, so working late, but you shouldn’t need a damn thing after that assessment.” Matthew never called back.

It all started when the Dow Jones Industrial Average dropped nearly 3,600 points during the week of February 24-28, including the sharpest one-day decline in market history. Fears of the coronavirus were apparently a driving force behind the panic, as investors fled equities and added to their bond market accounts. Others just sold out altogether — total liquidations — as a result of the virus crisis.

The last week in February also saw the benchmark U.S. 10-year Treasury yield setting a new record low of 1.14 percent. Shortly after, in early March, the 10-year yield fell below 1 percent. A few days later, it fell below .5 percent. All of this because of a respiratory virus that saw just 11 deaths in the U.S. on March 5, to 9,600 deaths by April 5, 2020. The economic effect of that is terrifying. Who knows what those figures will be when this print product reaches readers.

Some shares of company stocks, including Apple, entered bear market territory (losses of 20 percent or more) in late February for a day or two. Microsoft officials said during that week that its personal computing division would not meet first quarter revenue projections due to a slowdown in its supply chain from China.

Also during the last week of February, company after company issued warnings that they would miss their projected earnings this year. Ninety-six percent of the S&P 500 lost at least 10 percent of their stock value in the last week of February.

During the same week, the entire stock market entered a correction with over a 10 percent crater. By March 11, the Dow was down 20 percent from its February high, meaning we entered bear market territory. The stock market has not seen a bear market in 11 years.

The market has not been this volatile since 2009. On March 4, 2020, however, former Vice President Joe Biden’s strong showing in the Super Tuesday election helped lift stocks to the second-best point gain in market history, according to Fox News. The Dow Jones Industrial Average rallied almost 1,200 points on March 4, the day Michael Bloomberg quit his bid for the Democratic presidential nomination and firmly placed his support behind Joe Biden. Then on March 5, the market crashed again. In short, this economy is all over the place and it’s a crapshoot with the market all the way into mid-April.

A bear market would enter the fray on March 9, as the Dow Jones Industrial Average fell by over 2,000 points. It was the worst trading day since 2008. The wild swings in the market were happening as investors grappled with the sinking price of oil and the spread of the coronavirus.

Then on Friday, March 13, stocks rallied from their worst day in more than 30 years to their best day since 2008 after President Trump announced a National Emergency and leaders of private companies in the U.S. agreed to help with testing of the virus. Volatile? Are you kidding me? As of this writing, we have weeks, if not months, of volatility left in the stock market. It is almost useless trying to predict the stock market, even for the experts.

The China factor

.jpg) One of the biggest economic fears when the virus began in China is the fact that the second largest economy in the world is the world’s factory floor. When workers there are told to stay at home as a result of the virus, the world sweats it out. Many factories, schools and colleges in Japan and China were closed in late February and much of March. Fortunately, many of the schools and factories in China, Japan and South Korea reopened by April as the virus retreated.

One of the biggest economic fears when the virus began in China is the fact that the second largest economy in the world is the world’s factory floor. When workers there are told to stay at home as a result of the virus, the world sweats it out. Many factories, schools and colleges in Japan and China were closed in late February and much of March. Fortunately, many of the schools and factories in China, Japan and South Korea reopened by April as the virus retreated.

The U.S. economy for the past two years has seen trade with China crater as a result of tariffs. Tariffs have already had an immense negative effect on trade via supply chains. Tariffs have reduced foreign direct investment (FDI) flows to the United States from $471 billion in 2016 (pre-tariffs) to $253 billion in 2018 (post-tariffs). Note 1: The tariffs implemented by President Trump were designed to increase FDI, the idea being that foreign companies would bypass the tariffs by building more plants in the U.S. The numbers more than two years into the implementation of the tariffs show the exact opposite is happening. Note 2: There is nothing political about these FDI totals. I just count this stuff up regardless of who is the president.

Add the coronavirus to the tariffs and I cannot remember a time in my life when the worldwide supply chains have been more disrupted. In other words, we are experiencing a double whammy — tariffs and the virus — on worldwide commerce and trade, especially with China.

In early March, Forbes published an article that essentially projected that the coronavirus will end up being the “final curtain” on China’s 30-year reign as the world’s leading manufacturing nation. I am not so sure about that claim. The article was written at the height of the virus. The number of those infected by the virus in China has dropped significantly.

The Forbes article predicted that Mexico will benefit the most from issues resulting from the virus. But supply chains cannot change dramatically overnight. It will be interesting to see how tariffs and this virus affect supply chains worldwide. In the Forbes piece, experts predicted the China fallout would redirect FDI — $12 billion to $19 billion a year — from China to Mexico.

So how bad was the last week of February to April?

In 75 years, the S&P has seen only 26 market corrections, according to CNBC in an article it published the last week of February. So corrections of 10 percent or more — especially in one week — are rare. Here is what CNBC’s Fred Imbert wrote in that article: “During those corrective periods, the S&P 500 has declined by an average of 13.7 percent and has taken about four months to recover. That’s of course if they don’t turn into bear markets.” Well, there is no comparison to market histories with the coronavirus. It is charting new territories.

For example, the markets totally collapsed in March. At one point during the month, the Dow Jones Industrial Average had dropped 10,000 points, or one third its February high. The uncertainty swirling around the pandemic is spooking everyone.

Federal officials came in with a massive $2.1 trillion stimulus deal, just to get everyone on their feet, including workers and companies of all sizes. As of the end of March, there were millions of workers that had lost their jobs. Treasury Secretary Steven Mnuchin said in March that unemployment reports in early April might see an unemployment rate rise from 3.5 percent in February to 20 percent in April. We believe the May unemployment mark will be much higher than 20 percent.

Other issues with this economy

There are other issues affecting the U.S. and the South’s economy. The chief demographic challenge is simply the void of people. We have a record number of people aging out of the workforce and a record low number of people entering the workforce. For decades after World War II, we could count on 200,000 people on average turning working age (16) per month. By 2025, that figure will drop to an average of 50,000 people turning working age per month, according to the Bureau of Labor Statistics and the Census Bureau. It gets worse. In some states today, there are more Baby Boomers dying than there are people born. The last two years have seen the lowest birth rates in this country since the Great Depression.

We have written about the subject of low birth and high death rates for four years now. We have written ad nauseam about the fact that we simply do not have enough people in this country to fill millions of job openings. The coronavirus will obviously change that.

There were over 7 million job openings eight months ago and we were chipping away at that figure at 1.8 million job gains on average each year over the past three years. Now, the economy has slowed and there are about 6 million job openings in the U.S. By the time this article is published, there might be 4 or 5 million job openings as a result of the coronavirus. There might be none.

Still, there are more job openings than there are people out of work. The 273,000 jobs created in February 2020 was a great total, but that was prior to the virus. With this pandemic, there is no question that millions in the U.S. have lost their jobs, at least temporarily.

So what is the answer to low birth rates and high death rates? There are three answers: (1) Accept slower growth in the economy; (2) Increase tax credits for those having children to boost birthrates; (3) Increase legal immigration. There is nothing political about those three choices. It’s just math.

This administration has cut legal immigration from an average of 1.1 million per year over the last 10 years to 200,000 in 2019. Just when we need more legal immigrants, they are cut by more than 80 percent. However, not everyone in President Trump’s administration believes in cutting immigration. In fact, Trump’s chief of staff said recently that we need to ramp up immigration dramatically.

Acting White House Chief of Staff Mick Mulvaney spoke at a private meeting in the United Kingdom in February saying that the U.S. “desperately needs” more people. Multiple media assets quoted Mulvaney saying, “We are running out of people to fuel the economic growth that we’ve had in our nation over the last four years. We need more immigrants.” Note: Mick Mulvaney lost his job in the first week of March. Trump fired him.

Is it controversial in this political environment to claim that the only way out of this dire demographic situation is to increase legal immigration in this country to 2 million or 3 million people per year? It shouldn’t be. It’s math and it’s the only way out as Mulvaney said. Then again, the U.S. has never accepted more than 2 million legal immigrants in a single year since data has been produced (1900).

Mulvaney’s claims that “we need more immigrants” is in stark contrast to Trump senior policy advisor Stephen Miller. Miller has worked hard to not only cut illegal immigration, but legal immigration as well. And he has accomplished his goal. We haven’t seen a year when only 200,000 legal immigrants were admitted into the U.S. since World War II.

Until now, neither the Obama administration in its last few years or the Trump administration seemed to understand that (1) without people, our economy cannot grow; (2) without a growing population, Social Security and other social programs such as Medicare cannot be funded.

Social programs like Social Security and Medicare are funded generationally. That means the taxes taken out of my paycheck today pay for my parents’ social programs. If there is a generation when less people are paying FICA, those social programs will undoubtedly be in jeopardy. You’ve heard reports that the Trump administration may cut Social Security and/or Medicare. Now you know the reason why. We simply do not have the population growth that can support these programs.

Social programs like Social Security and Medicare are funded generationally. That means the taxes taken out of my paycheck today pay for my parents’ social programs. If there is a generation when less people are paying FICA, those social programs will undoubtedly be in jeopardy. You’ve heard reports that the Trump administration may cut Social Security and/or Medicare. Now you know the reason why. We simply do not have the population growth that can support these programs.

A tsunami of economic challenges

Is climate change real? That’s for you to decide as it, like immigration, has become politicized like so many other things that affect our lives. The vast majority of scientists view climate change, specifically rising seas and warmer weather, as fact. Data also supports that fact in that recent years have been the warmest in history. Doubters believe the rising temperatures are cyclical. What if they aren’t cyclical? What if rising temperatures and seas are here to stay? Certainly the experts in the site selection community must factor these developments in their proposals for new and expanding industry.

My stepfather died a few years ago. He was a smart man, a Latin professor at University of Alabama Birmingham. He was also a devout agnostic. At his funeral, one of his best friends, a reverend, spoke during the ceremony and told the story about trying to convince my stepfather that he should “believe in God, just in case.” Should we believe in climate change “just in case?”

Our president believes climate change is a “hoax,” and has struck down all kinds of regulations to lower carbon emissions in this country. His goal is to reduce regulations, therefore freeing industry to expand without as many environmental restrictions in an effort to improve the economy. Problem is, most companies, including the automotive industry and other manufacturers, have adjusted their platforms to conform to the new environmental rules and regulations set forth under previous administrations.

President Trump — not Congress — also withdrew from the Paris Agreement, an environmental pact among almost every country in the world to battle climate change. According to the United Nations: “The Paris Agreement builds upon the Convention and for the first time brings all nations into a common cause to undertake ambitious efforts to combat climate change and adapt to its effects, with enhanced support to assist developing countries to do so. As such, it charts a new course in the global climate effort.

“The Paris Agreement’s central aim is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century to below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius. Additionally, the agreement aims to strengthen the ability of countries to deal with the impacts of climate change. To reach these ambitious goals, appropriate financial flows, a new technology framework and an enhanced capacity building framework will be put in place, thus supporting action by developing countries and the most vulnerable countries, in line with their own national objectives.”

Technically, the U.S. is still a part of the Paris Agreement. President Trump announced it would cease all participation in the 2015 Paris Agreement on climate change management on June 1, 2017. His objections were that the agreement would hamper American business interests, even though just about every country in the world, including Russia and China, have signed on to make efforts to keep temperature increases below 1.5 degrees this century.

As written, Trump, through an executive order, announced in June 2017 the U.S. would leave the world effort of confronting climate change. But rules of the agreement are clear; the earliest possible effective withdrawal date by the United States cannot happen before November 4, 2020, four years after the Agreement came into effect in the United States and one day after this year’s U.S. presidential election. In other words, the U.S. must continue reporting its emissions to the United Nations until the next president is elected.

So, what if climate change is a hoax? What if this is simply a random weather pattern that comes and goes? There is only one answer for that: we have nothing to worry about, at least for several generations after us, depending on when the hotter weather patterns cease. But for now, it doesn’t look good, at least for Baby Boomers, GenXers, Millennials and those being born today.

The South is ground zero for climate change

The South is ground zero for climate change

For more than 50 years, no U.S. region has grown like the 15-state American South that this publication covers. In 1955, the Midwest, the Northeast and the South all had about the same population — between 54 million and 56 million residents. Today, the South is home to 125 million people. The Northeast has 63 million residents and the Midwest has 62 million. That means the South is home to as many people as the Northeast and Midwest combined.

The South leads all U.S. regions in just about every economic category tracked by the U.S. government. For example, the South’s gross domestic product was $6.6 trillion in calendar year 2018. The next closest region in GDP was the West with $5.1 trillion. The South’s GDP is almost double that of the Midwest’s.

In an age of labor constraints and record low birth rates, the South, more than any other region, is where more people in the country migrate to each year. Texas and Florida are migrant magnets, and so are just about all Southern states, including Georgia, North Carolina, South Carolina and Tennessee. In fact, the South led all regions in 2019 with population growth of 0.81 percent. The rate was followed closely by the West at 0.66 percent. However, the Northeast’s population dropped by slightly more than 0.1 percent.

In 2018, migration to the South was well over 1 million people. Most of the migration to the South — both temporary and permanent — is weather-related. There are tens of millions of people that were born in the Northern U.S. now living in the South, and the No. 1 reason is the mild weather in winters. In fact, many “snowbirds” as they are called by native Southerners, move to the South in the fall and return to their native states such as Michigan, Minnesota, New York or elsewhere like Canada, in the spring.

Within the next 30 to 100 years — no expert seems to agree on the timeframe — will Northern climates in the U.S. be suitable in the winter as a result of global warming? Furthermore, will global warming in the next two to four generations reverse the snowbird effect? In other words, could there be a time in the future when people from the South migrate to the North in the summer simply because it is too hot? Think about the ramifications of that when it comes to American demography.

While the population of the South greatly surpasses other U.S. regions, a too-hot-to-live South in the summer could be a big problem economically for the region. There are days in the South during the summer when outdoor work is an impossible task. That alone will slow the region’s growth.

If climate change is a reality and seas and temperatures continue to rise, the South will be ground zero for a changing nature. In other words, places in the U.S. where it is already hot, like Arizona, Texas, Florida, Georgia, Alabama and the like, may take an economic hit each summer. Construction work would slow as there will be days when it just can’t be done.

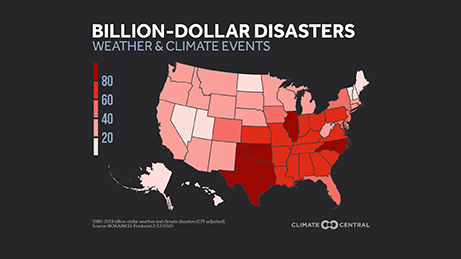

In a study in 2017 by the journal Science, researchers analyzed the economic harm that global warming could do to the U.S. Their research showed that while the South may be ground zero for a hotter climate in the U.S., states such as Michigan, Minnesota, Maine and Montana would actually benefit from a warmer climate. In other words, their research showed that not all states would suffer equally.

This would also apply worldwide. Hotter countries in tropical zones such as those in Africa and Southern Asia would see deadly heat waves, while people in countries in Northern Europe would hardly notice the change in temperatures.

Causes of global warming

A majority of scientists believe that global warming is caused by higher levels of greenhouse gases. The gas creates an overlay that traps heat from the sun and sends it back to the Earth’s surface. Most of these gases are the result of burning fossil fuels, such as coal and natural gas for electricity generation, transportation, industrial plants such as oil and chemicals, and the commercial and residential use of heating oil.

NASA recorded carbon dioxide levels in December 2019 of 412 parts per million. According to Scientific American, the last time carbon dioxide levels were that high was 2.6 million years ago during the Pliocene era. At that time, the Arctic was 14 degrees Fahrenheit warmer in the summer than it is now. So, the Arctic was frozen only during the winter in the Pliocene era. Back then, sea levels were 98 feet higher than today, high enough to flood New York, Miami, London and Shanghai. The reason the Earth is not as hot as it was then is that greenhouse gases have risen so quickly since 1900, temperatures have not had a chance yet to catch up.

The Intergovernmental Panel on Climate Change (IPCC), a group of more than 1,300 scientists from the U.S. and other countries, forecasts temperature rises of 2.5 to 10 degrees Fahrenheit over the next century. Once again, the IPCC maintains that the effects of global warming on individual countries and regions in those countries will vary over time, and places that are already hot will suffer much more than colder climates.

There is a 100-year-old joke (or maybe it is accurate) in economic development circles that claims the greatest effect on the South’s rise in its economy from dirt poor to the home of major economies such as Dallas-Fort Worth, Atlanta, Charlotte, Austin, Nashville, Northern Virginia and the like, was the invention of the air conditioner. That said, if it took the invention of the air conditioner in 1902 to bolster the region’s economy, it was obviously too hot to live comfortably in the South. If global warming hits increases on the extreme scale of 10 degrees Fahrenheit, it would be too uncomfortable to live in the South in the summer, air conditioning or not.

Weather and site selection

In 1993, Southern Business & Development published a map of the South showing the number of tornadoes that touched down in each county in every state in the region since 1950. The data was provided by the National Oceanic and Atmospheric Administration, and showed that some counties in the South saw more than 170 tornado touchdowns since 1950, while an adjoining county only saw 20. It was remarkable site selection information to share, even before the internet was widely used.

Look up “most tornado-prone counties in the U.S.” on the internet today and you will find that Weld County, Colo., is the No. 1 county with 262 tornado touchdowns from 1950 to 2016. Caddo County, Okla., just west of Oklahoma City, was well up the list of the most tornado-prone counties in the U.S. In May of 2003, the General Motors assembly plant in Oklahoma City was hit by a massive tornado. The plant closed three years later.

As with tornadoes, weather has a tremendous effect on site selection. And if our weather is about to turn for the worse as a result of climate change, what are site consultants telling their clients as they ponder new, expanded or relocated projects? We asked Mark Williams, a South Carolina-based site consultant, how global warming has changed the corporate and industrial site selection industry. “The greatest concern in today’s searches relates to higher awareness of flooding,” Williams said. “I can’t refer to any specific data that exists, but 15 years ago we were thinking about 100-year flood plains. Now we are looking at 500-year flood plains and overall greater evaluation of drainage. The concern is widespread.”

As with tornadoes, weather has a tremendous effect on site selection. And if our weather is about to turn for the worse as a result of climate change, what are site consultants telling their clients as they ponder new, expanded or relocated projects? We asked Mark Williams, a South Carolina-based site consultant, how global warming has changed the corporate and industrial site selection industry. “The greatest concern in today’s searches relates to higher awareness of flooding,” Williams said. “I can’t refer to any specific data that exists, but 15 years ago we were thinking about 100-year flood plains. Now we are looking at 500-year flood plains and overall greater evaluation of drainage. The concern is widespread.”

Conclusion

Pandemic is a scary word. It means schools are closed, no sporting events, all public gatherings essentially halted on the spot. Restaurants, unless they have a drive through, are closed. Your favorite bar is closed.

But don’t panic. If this is a 10- to 12-week situation and the $2.1 trillion stimulus is put in place and delivered quickly, there is a possibility our economy could be revived at a rate never seen before. After all, even though the U.S. was in a manufacturing recession just before the coronavirus event, we did not fall into recession because people were not buying things. Retail and services in general were the only thing propping this economy before the virus. Now that is gone.

We have survived dark times before and emerged shining. Still, there is no sugarcoating the situation at this writing. In a matter of 90 days, millions of jobs have been lost, at least temporarily, in just about every sector of business.

This recession is not like the Great Recession which was a slow bleed. It is, as you may have heard, more like 9/11. A shock, a bomb, a trauma, a bad surprise and the result is turmoil, for your family and everything around you, including the governments that assist you.

Combine all that with demographic challenges in terms of the lowest birth rate in nearly 100 years and you have double trouble. Throw global warming into the mix and this is the most problematic and depressing cover story I have written since 2008 — if not in my entire 40-year journalistic career — because it is triple trouble.

Yet, the U.S. economy has been resilient for 11 years now. The U.S. remains in its longest recovery period in history, until the economists and the government tell us that this is the end of an 11-year recovery. Officially though, we can’t fall into a recession unless GDP falls for at least two quarters. I am confident GDP, during this deal, will fall for two-straight quarters.

The U.S., as a place to operate a business, is as competitive as it has ever been for manufacturing, technology and other sectors. Competitive in that costs of doing business remain low in the U.S. and much lower in the South.

However, if the U.S. and the South’s historic 11-year economic run is at an end, even temporarily, this is the time, based on the circumstances, for it to end. A headwind is blowing and it is at our door.

Finally, if the U.S. is indeed in recession as of the winter quarter and spring quarters, there is a silver lining for the South’s economy. We have been writing about economic development in the South since 1983, and we have seen plenty of downturns over the last 37 years. There were the recessions of 1991-1992, 2001 and 2007-2009. We survived all of them and then we prospered.

About that silver lining: In all of those years, project activity in the South in the form of relocations — not necessarily new and expanded projects — increased dramatically. You see, if you are making money hand over fist in New York, California or Illinois in an expanding economy, operating in those high-cost states is acceptable. But when the economy turns sour, those companies look for less costly locales and the South is just that — the lowest cost place to operate a business in the world’s largest economy.