This economy is taking us on a wild ride. In the fall of 2019, we saw data indicating a pending recession and data supporting what is unquestionably the largest surge of projects we have seen in a single quarter in the South (even stronger than the late 1990s). When November and December arrived, economic development project activity just took off, with the tech sector and services leading the way. Manufacturing also came back in December after four months of contraction.

The fall quarter of 2019 certainly took us on a wild ride, one that we have rarely seen. In 27 years of publishing this magazine on economic development in the South, I have never seen project activity as strong as what we saw in November and December. Typically we can publish nearly 80 percent of all significant projects on our eight- or nine-page Relocations and Expansions section found in this issue on page 29. In this issue, we couldn’t come close to publishing half of them. (They are all on SB-D.com, the magazine’s website.) We would have needed 20 pages to publish every significant project announced in the South in the fall of 2019.

As the fourth quarter started, the stock market was soaring, breaking all-time records on the Dow Jones Industrial Average. Unemployment at the end of the fall quarter was at a 50-year low, even though there’s hardly any more labor left for employers to hire. Many Southern states are currently enjoying their lowest unemployment rates in history, including Alabama and Georgia. We hear all the time that companies cannot find enough labor, or at least skilled labor. Then, in November, the economy added a whopping 266,000 jobs. Conflicting data is all over this economy in the last quarter of 2019.

Then again, at the beginning of the fourth quarter, data from the manufacturing sector was disturbing. In November, for the fourth consecutive month, manufacturing contracted. The Institute for Supply Management’s manufacturing index rose to 48.3 in October, up from 47.8 in September. But in November, it dropped again to 48.1. Anything below 50 signals a contraction, and if it runs six consecutive months under 50, it technically signals a recession in that sector. Then December arrived and every sector went deal crazy, including manufacturing.

However, you cannot hide the fact that those four months beginning in August were the lowest from the U.S. manufacturing sector in 10 years. In the last 10 years, manufacturing has been one of the bright spots in the economy as the U.S. became incredibly competitive for plants of all types, mainly because of the low cost and bountiful supply of domestic natural gas. The manufacturing sector added over 1.2 million jobs during this 10-year expansion, the first decade of plus-employment in manufacturing in decades.

But that was then and this is now. The export orders index was only at 41 percent in the third quarter, the lowest level since March 2009, four months before the end of the Great Recession. It doesn’t take an economist to see that in terms of manufacturing and overall exports, we have tariffed ourselves to not only a U.S. manufacturing downturn, but one that is also a global manufacturing downturn. Then November and December arrived and a rising tide lifted all boats.

I can’t write with confidence that if the tariffs are in place for two more months, we will be in a manufacturing recession. Not with this ever-changing economy. When December arrived the number of new and expanded projects just exploded. So, as if on cue, some sort of trade deal was struck by the U.S. and China in the middle of December that is still short on details. U.S. officials said it will reduce tariffs on $120 billion in products to 7.5 percent, meaning plenty of tariffs still exist. As I have written many times, tariffs do one thing: less is sold and what is sold costs more.

It’s not just the tariffs themselves that have slowed the manufacturing sector. The uncertainty is the real culprit. When will the tariffs end? Will they end? And which countries will the U.S. be able to begin free trade? Conflicting news reports that the tariffs will end, expand, or be reduced has manufacturers scratching their heads. Because of that, they are reducing inventory and new investments. Why wouldn’t they if they have no idea what the economic, import and export rules are, or how they will change in coming months or years?

Then again, we are seeing some movement by foreign manufacturers to build plants in the U.S. to bypass the tariffs. I believe President Trump’s original intent, regarding tariffs, was to compel foreign manufacturers to make a beeline to the U.S. But that hasn’t happened. Not yet, anyway.

The problem with that strategy is that foreign manufacturers have always regarded the U.S. as a manufacturing beachhead, especially for North American consumption. In some years, more than 65 percent of foreign manufacturers chose the South over the three other U.S. regions. Two-thirds of all manufacturing job gains in the U.S. since the end of the Great Recession have come from foreign-owned companies. So, there is no need to juice foreign manufacturing recruiting to the U.S. The U.S. economy is the largest in the world, and the South is the third largest economy in the world. Foreign manufacturers will always be drawn to the South.

An economy being propped up by consumerism

An economy being propped up by consumerism

In the third and fourth quarters of 2019, consumers continued to prop up the economy. Consumer spending grew by 2.9 percent in the third quarter, even though GDP only grew by 2.1 percent, down from 3 percent growth at the start of the year.

Two-thirds of the U.S. economy is based on consumer spending, so that part of the economy is intact for now. The U.S. saw retail sales jump in July to the highest level in four months after retail sales grew for six straight months. Then in September, retail sales unexpectedly slumped and economists started to worry that the bright spot in the U.S. economy may be dimming.

Then news came out about the shopper’s biggest weekend of the year. It’s called “Black Friday” because that’s when most retailers make it into the black for the year, or so we are told. According to Adobe Analytics, shoppers spent $4.2 billion online on Thanksgiving Day, a 14.5 percent increase from last year and a record high. On Black Friday this year, shoppers spent $7.4 billion online according to Adobe, also a record high and a 19.2 percent increase from last year.

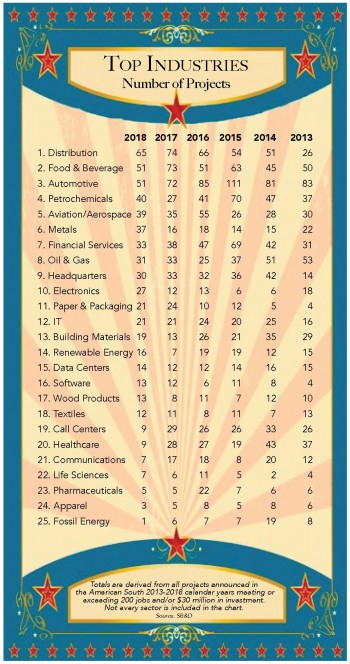

Supporting solid consumer spending, the distribution sector—led by dozens of Amazon fulfillment centers—has topped all industries the past two years in project activity in the South. In fact, Amazon has created hundreds of thousands of jobs in the U.S. over the last five years, minus any disruption of jobs it cost in the storefront retail sector.

While retail spending is setting records, there are other signs that the economy is slowing. As mentioned, we began the year with 3 percent growth in GDP, after 3.2 percent and 3.5 percent growth for some quarters in late 2017 and in 2018. Yet, this time last year, GDP grew at just 1.1 percent and some Federal Reserve projections have GDP barely growing at all (0.4 percent) in the fourth quarter of this year. Others predict the economy will grow at a high of 1.4 percent in the fourth quarter. But, with 266,000 jobs created in November, and literally hundreds of new projects announced in November and December, who knows what type growth we will have in the fourth quarter.

After a slow summer of projects, November and December brought a blur of activity. There were some outstanding projects announced, such as Q2 Solutions, a clinical trial company for biotech companies. That company announced a 749-job deal in Durham, N.C., in November. Also in November, Brazil-based Guidoni Group, a producer of ornamental stones, announced a $96 million project to locate a manufacturing facility in McRae-Helena, Ga. The deal will create 455 jobs.

In December, Amazon announced work in Mt. Juliet, Tenn., on one of the South’s largest current projects. Amazon is building a new 3.6-million-square-foot warehouse in the city located east of Nashville. The deal is expected to create 1,200 jobs. Microsoft added over 400 new jobs in Charlotte in November and Charles Schwab announced it was relocating its San Francisco headquarters to Dallas-Fort Worth. Nestlé Purina opened its newest pet foot plant in Hartwell, Ga. The $320 million deal will create 240 jobs. Finally, Apple Inc. broke ground on its $1 billion North Austin campus in November. The new location is expected to house 5,000 workers when it opens in 2022 and as many as 15,000 in a few years. So, in November and December, frantic project activity in the South restarted in earnest after a slow go in the summer and the beginning of the fall quarter.

Is the largest industry in the South in recession? Hard to tell.

Is the largest industry in the South in recession? Hard to tell.

There is no question that the automotive industry is essentially in recession when it comes to project activity in the Southern Auto Corridor. Or is it? Like everything else regarding the economy in the second half of 2019, there is conflicting data. Dallas-Fort Worth-based Toyota North America posted its best November ever as vehicles sales jumped over 9 percent. But Toyota has had a down year overall in 2019 compared to last year. Regardless, in the fall, Toyota announced it would invest $238 million to launch assembly of two hybrid vehicles in Kentucky, adding 400 jobs.

Then, again, Nissan, which has two large assembly plants and a massive powertrain plant in the Southern Auto Corridor, is cutting worldwide production capacity by 10 percent and 12,000 jobs. The Japanese automaker, which has its North American headquarters in Nashville, announced in November it is forcing its U.S. factory and office employees to take two days off without pay amid slumping sales. Nissan’s sales are down almost 8 percent through November.

Automotive is the South’s largest industry. Volkswagen is adding a new vehicle to its lineup in Chattanooga, as is Hyundai in Montgomery, and those two projects will create 1,200 jobs. Ford is investing $1 billion in its plants in Louisville. Of course, the Mazda Toyota assembly complex in Huntsville is well underway and is expected to open its first line in April 2021 and its second line in August 2021, sans recession. Both lines will produce Toyota and Mazda branded vehicles. The facility will house 4,000 workers.

In November and December, we saw lots of activity in the Southern Auto Corridor. Again, with manufacturing flirting with recession and exports down across the board, the sudden activity in the South for the automotive industry makes little sense. After all, other plants in the U.S. are slowing down production or are closing altogether. This time last year, GM announced it was closing five plants in North America and cutting 14,000 jobs.

Job losses in the manufacturing and automotive sectors are nearly double the number of losses in the first nine months of 2018. In the first three quarters of this year, manufacturers announced almost 61,000 layoffs or job cuts, up 194 percent from the 21,000 jobs lost in 2018 in the same period. Job losses in automotive have increased by 194 percent as well, from 14,000 last year to over 41,000 this year in the first three quarters. Then in December, Ford announced it was adding 3,000 jobs at two Michigan plants. Again, just a roller coaster of conflicting data regarding the current economy, not only in the South, but in the U.S. as a whole.

There is so much disruption in the automotive sector, especially in the South, that it is difficult to determine how the industry is faring. Currently, Mercedes-Benz (Alabama), Volkswagen (Tennessee) and other automakers are spending billions on new battery plants to secure the future of electric vehicles built in the Southern Auto Corridor (see SouthernAutoCorridor.com). This disruption in auto assembly and auto power is challenging all automakers.

In terms of total deals meeting or exceeding 200 jobs and/or $30 million in investment, the automotive industry has topped all other industry sectors — manufacturing or services — in 23 of the last 26 years in the South. But that was not the case in 2018 when only 55 automotive projects were announced in the South. That figure was half of the sector’s peak of 111 deals in calendar year 2015. Automotive wasn’t at the top of 2017 either in terms of project activity.

Then in November of 2019, a sure sign of a downturn was announced. Volvo Trucks North America announced it would lay off 700 production workers in January 2020 at the company’s New River Valley plant in Dublin, Va. Like many things in today’s economy, that layoff is somewhat shocking. Volvo Trucks announced in September it would invest $400 million in the plant, then in November announced the layoffs. Again, conflicting data.

Volvo Trucks cited a decline in orders for the layoffs. Trucking industry publication Freightwaves expects the overall heavy-duty truck market to be down by some 100,000 units next year. Much of the trucking industry has slowed in the last two quarters when it was booming at the beginning of 2019. Yes, these are conflicting signs. The Volvo plant had nearly doubled employment at its New River Valley plant from 1,700 in January 2017 to 3,300 to meet demand in 2018. Then the bottom dropped out.

But what is so concerning about deal activity in the South is the fact that financial services projects have fallen more than 50 percent since they peaked in 2015. Financial services project activity is the canary in the coal mine. Big drops in financial deals occurred just before the Great Recession. In 2015, financial services announced 69 projects of 200 or more jobs in the South. Last year financial services announced 33 deals of 200 jobs or more. We also saw financial services deals fall in 2005 and 2006 before the Great Recession, until they completely collapsed in 2008 and 2009. The U.S. housing crisis began in Florida as early as 2004. We don’t see any signs of a housing crisis today. At the height of the recession, 2008 financial services deals totaled a mere eight and in 2009 only five.

Manufacturing downturn detailed

Since coming out of the recession in the summer of 2009, the overall economy has contracted only twice; once in the first quarter of 2011 and again in the first quarter of 2014, periods not long enough to qualify for a recession. It takes at least two consecutive contracting quarters to qualify as a recession. That last contraction in 2014, however, was followed by a 5-plus percentage growth in GDP in quarters two and three of that year. We haven’t seen anything close to 5 percent GDP growth since, no matter what you have heard or read. Then again, we haven’t seen unemployment this low in 50 years.

Coming out of the recession, things looked very rosy for manufacturing. With the mass mining of natural gas, the cost of operating manufacturing plants in the U.S. dropped significantly. The U.S., especially the South, was suddenly again very competitive on the manufacturing front as wages increased dramatically in China at the same time that natural gas was taking over the energy industry in the U.S.

The report, “Made in America again; Why manufacturing will return to the U.S.,” by the Boston Consulting Group came out in the summer of 2011. The report made the case that manufacturing in the U.S. would thrive post-recession and it did, but the report was about four years too late. We started seeing manufacturing project activity deals rise in the South as early as 2007.

In 2007, for the first time in 11 years, project activity in the manufacturing sector in the South increased dramatically. Considering the fact that manufacturing projects meeting or exceeding 200 jobs and/or $30 million in investment overtook services after getting beat for 11 straight years was a remarkable event. After all, everyone believed manufacturing was gone for good in this country as company after company raced to China in a herd mentality.

Then something happened. We — especially the South — became incredibly competitive for the manufacturing sector. Thing is, manufacturing has beaten services using those job and investment thresholds every year since 2007. I will predict, though, if services is set up to beat manufacturing deals using those thresholds, 2019 will be the year. We won’t know until the spring of next year with the release of our annual SB&D 100 issue.

What clearly occurred in the Great Recession was this: manufacturing did not collapse, services did, as seen in the disintegration of deals like the aforementioned financial services sector. Financial services’ lack of project activity has returned to today’s economy. However, today, it is obvious that manufacturing is close to recession and services — specifically retail — are keeping the overall economy afloat.

As mentioned, manufacturing created well over a million jobs from the depths of the recession to today after decades of job losses that totaled in the millions. So the Boston Consulting Group’s report was accurate. Here is a quote from the report in 2011: “China’s overwhelming cost advantage over the U.S. is shrinking fast. Within five years, a Boston Consulting Group analysis concludes, rising Chinese wages, higher U.S. productivity, a weaker dollar, and other factors will virtually close the cost gap between the U.S. and China for many goods consumed in North America.” The quote was dead on, as manufacturing and output increased dramatically in the U.S. for more than a decade.

Those job gains in manufacturing now have leveled off. There is one thing that the Boston Consulting Group could not predict in its report — the trade war the U.S. has waged with China and Europe and vice versa. Since the tariffs took hold, the manufacturing sector in the U.S. has cut tens of thousands of jobs. NBC News reported in October that Michigan, North Carolina, Pennsylvania and Wisconsin — incredibly important states in the 2020 presidential election — lost a total of 27,000 manufacturing jobs from January through September of 2019.

As for the tariffs, exports to China have fallen dramatically, and they are not exclusive to farming after retaliatory Chinese tariffs were put on U.S.-farmed soybeans and pork (those tariffs were waved by China in November). More than 30 U.S. states have seen their export totals to China drop by double digits according to the U.S. Commerce Department.

Alabama, which is the nation’s No. 3 auto exporting state, has seen a 49 percent drop in exports to China in the first nine months of this year. Oil exports from Texas have dropped by 39 percent to the world’s second largest economy. Overall, exports from the U.S. to China have fallen 15 percent nationwide.

But there are some bright spots in the trade war, giving us more conflicting data. South Carolina, where the Boeing 787 Dreamliner is made, has seen a 30 percent increase in Chinese exports in the first three quarters of 2019. Almost the entire increase was from Boeing airplane exports, where final assembly is done by the company in North Charleston, S.C. Also, since U.S. tariffs have targeted semiconductors that are made in China, U.S. companies have increased their purchases of U.S.-made chips from companies in states such as Texas, Oregon, California and Massachusetts.

Services: Propping up today’s economy

Manufacturing has slowed to levels not seen since the Great Recession and the tariffs are undoubtedly the self-inflicted reason. Yet, services for the most part are thriving because the sector is not subject to tariffs. We have already discussed the record-breaking retail industry. So, unlike the beginnings of the Great Recession, services are driving this economy while manufacturing is faltering.

Retail is not the only services sector driver. Tech continues to create gobs of jobs. Some of the South’s largest tech deals in history have been announced in the last 12 months. It started with Amazon’s HQ2 announcement in Arlington, Va., in November of 2018. That is the largest single job total announcement in the South’s history with 25,000 jobs.

As mentioned, Apple broke ground in November on its new $1 billion campus in Austin. The project will create as many as 15,000 jobs. Here are some of the most notable tech and selected service deals announced in the South since Amazon’s HQ2 project. These are some of the largest service sector projects announced this year, many of which will create at least 1,000 jobs.

Winter 2019

Spring 2019

Summer 2019

Fall 2019

As you can see, the service sector, specifically tech and distribution that serves the retail industry, just went nuts in the fall — many in November — in terms of job announcements. Those deals clearly support the Labor Department’s announcement that 266,000 jobs were created that month, the second highest total this year.

The U.S. economy could expand to heights not seen in years, but it could also fall into recession within months after factoring in what has occurred from the summer to winter. The 266,000 jobs created in November is very encouraging.

Conclusion

There is no question there are conflicting flags flying in the third and fourth quarter regarding the U.S. economy, and they continue as the year ends. Data from various sources now show that services are slowing and the manufacturing downturn is abating. Services are propping up the U.S. economy. If they slow or contract, this economy is in trouble.

However, if a significant trade deal can be carved out with China, Europe and others, we could see the economy continue what is now the longest economic expansion in U.S. history. I still believe that this more-than-10-year expansion peaked in 2015, but it’s still got legs.