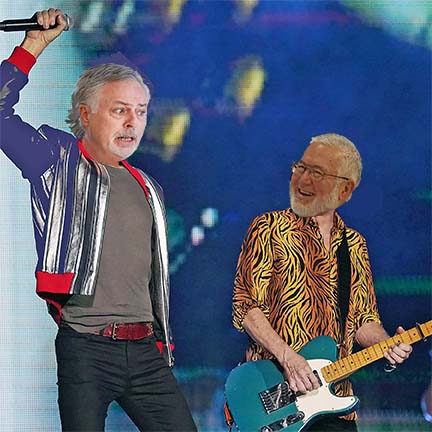

Economic Development Rock Stars in the South: Clif Chitwood and Mark Herbison

Economic Development Rock Stars in the South: Clif Chitwood and Mark Herbison

In a new feature added to this issue, SB&D will choose who we believe are the "Economic Development Rock Stars" of the quarter. This quarter's "Rock Stars" include Clif Chitwood, Mississippi County (Ark.) Economic Development. and Mark Herbison, President and CEO of The HTL Advantage, an economic development agency in West Tennessee that represents Haywood, Tipton, and Lauderdale (HTL) counties.

Tiny Mississippi County (population 47,000) is located across the river from Memphis in the Arkansas Mississippi River Delta. The county turned three big deals in the last two years. Mississippi County is the second largest steel producing county in the U.S. and will soon be No. 1 when U.S. Steel — which announced its $3 billion deal in spring 2022 — opens two electric arc furnaces and steel plant in 2024. The plant will hire 900. "This is the big one," said Clif Chitwood, director of the Great River Economic Development Foundation. “This will be Mississippi County’s best shot to rebuild our demographic infrastructure,” said Chitwood in a recent article.

Mark Herbison is one of the key players in capturing Blue Oval City, a Ford and SK Innovation development in his three-county territory. The multi-billion-dollar development will hire thousands and over $5 billion will be invested to manufacture EV batteries and the electric F-150 pickup truck.

The development is being built at the former Memphis Regional Supersite, a TVA-certified megasite in Stanton, Tenn., that has seen of late millions of dollars in improvements.

Rural development in Kentucky is special

Rural development in Kentucky is special

If there ever was state in the South where you could just exit a parkway or interstate and go exploring, Kentucky is it by a long shot in the 15 Southern states. For one, Kentucky is one of the South's oldest states. It's not as old as Virginia, but its small towns, especially those in the central part of the Commonwealth, are better preserved than much of Virginia’s. West Kentucky is a major agribusiness center, all the while improving and diversifying, and East Kentucky is still bound in large part by the coal industry.

Just look on the map and pick any number of small, historical towns in Central or Southern Kentucky, around Lexington and Louisville, and you will find some of the most beautiful land in the nation. The historic towns have remained true to their 1600’s and 1700’s roots. In these towns you will find delightful, active central business districts that feature quaint shops and dining. There is just no place like it.

An anchor for Central and East Kentucky when it comes to economic development is Kentucky’s Touchstone Energy Cooperatives and East Kentucky Power Cooperative, an expert source for rural Kentucky’s development. According to Brad Thomas of East Kentucky Power Cooperative, since 2015, Kentucky’s Touchstone Energy Cooperatives have seen 345 projects announced in the service territories representing over $9 billion in investment and almost 16,000 projected jobs created.

Here is just a sampling of small towns in Kentucky that are not only thriving in the practice of economic development, their "sense of place" is off the charts for those living and working there.

Kentucky’s Best Small Towns

Where is the labor? It was here, now it is gone again.

Where is the labor? It was here, now it is gone again.

By Michael Randle

I've discussed the subject of a tremendously shrinking labor shed in the South for years. Everything is stacked up against us and it is getting worse. A red flag was raised when the fertility rate among child-bearing women began to collapse about a decade ago. Many women don't believe they can afford to have children, whether the obstacle is low pay, inflation or student debt.

Recently, more bad news. Laws preventing or severely curtailing immigration—work visas—put in place by the Trump administration slowed legal and illegal immigration and the "Dreamer" program, affecting immigrants young enough to have been born in the U.S. but unable to file as a citizen, has never materialized.

Work at meatpacking plants, almost exclusively manned by immigrant labor, has slowed dramatically, at least for now. Immigration tapered off during the Trump administration — then almost ground to a complete halt for 18 months during the coronavirus pandemic.

According to several sources, the U.S. has 2 million fewer immigrants that drive the labor needed to build homes and prepare and pick food. Much of this has contributed to inflation which has resulted in the price of homes in places like Texas going up from $500,000 to $650,000.

And then COVID showed up and the labor force essentially was paralyzed to the point that it shut down.

Today, out-of-control inflation has also affected the labor situation in that companies have been squeezed by a lack of hiring as the consumer economy is hit hard by more than 40 percent inflation.

Need some examples of this? Try getting someone to answer the phone at your doctor's office, or getting a meal at a fast food restaurant. If you have not noticed, some eateries are now turning off their lights at night, knowing full well the staff on hand cannot possibly handle the night's orders. Turning off your lights to snuff out business at your restaurant? That's pretty bad.

Comparing Mexico's available labor to ours doesn't seem fair

Comparing Mexico's available labor to ours doesn't seem fair

One way or another, automakers in North America are subsidized by their governments. They may be underwritten in different ways, but the largest industry in North America usually gets what it asks for. When it comes to labor costs exclusively (discounting labor quality, innovation and such), Mexico has no peer. Then again, Mexico's labor situation is not exactly where the United State’s is. For example, there are so many levels of management in Mexico's labor shed, a significant negative effect is just part of reshoring of the Mexican supply chain. For the most part, U.S. labor is void of the middle management structure that would lose jobs in reshoring.

Mexico, by contrast, has an overwhelming advantage when it comes to labor costs. Using the average cost of supplementing labor in Canada and the U.S. per assembly plant, Mexico’s costs aren't even close. Again, just using subsidized labor costs, it would take six to 10 years for a plant in Mexico to run up a similar labor bill to those in the U.S. and Canada. Add on the fact that Mexico’s fertility rate is more than double that of the U.S., and it’s also clear that Mexico can backfill its labor for decades to come , while the U.S. is simply getting older and smaller. The only way to change that fact is to change immigration policy.

Chinese foreign direct investment in the South. Was it ever for real?

Chinese foreign direct investment in the South. Was it ever for real?

According to the Economic Policy Institute, U.S. jobs outsourced to China from 2001 to 2014 totaled 3.2 million. Of those, 2.4 million jobs were in the manufacturing sector. Approximately 1.1 million of those offshored manufacturing jobs to China came from the American South. Simply put, the U.S. was not competitive with China regarding costs to manufacture (particularly in labor costs) until about 2010. By then, labor costs in China were rising rapidly. Also in 2010, widespread hydraulic fracturing created an energy upper hand for the U.S. that can't be duplicated anywhere else in the world.

According to the Reshoring Initiative — a tracker of Chinese FDI — the bleeding of manufacturing jobs that came from offshoring has slowed. Their data shows that in 2003, 150,000 manufacturing jobs were offshored and just 2,000 were reshored. Conversely, in 2013 there was a "push" for the first time with an estimated 40,000 offshored manufacturing jobs and 40,000 reshored jobs. And of those 40,000 reshored jobs, approximately 90 percent came from plants returning from China to the U.S. and Mexico.

Here come the Chinese?

Over the course of more than 20 years, economic development officials in the South took hundreds of industrial recruiting trips to China in efforts to capture Chinese investments in the region. And for almost that entire time, those same officials had little, if anything, to show for their efforts.

Want proof that Southern economic developers were chasing ghosts in China from the mid-1990s to 2015? Okay, go ahead and name a Chinese-owned brand that's made in the South? Tick. . .tock. . .tick. You can't, can you? While Chinese FDI into the U.S. beginning in 2015 looked promising, many of the projects announced never materialized.

And with the Chinese “no COVID” policy, it is going to be tough to restart any FDI effort with the U.S. anytime soon, even though many Chinese officials see the need to diversify the world's two largest economies. Of course, Trump's tariffs with the Chinese during his time in office may have snuffed out the diversity that China seeks by investing in the U.S.

The mother of all deals

Korean automaker Hyundai announced in late May it will open an auto plant and EV battery factory in Bryan County, Ga., in 2025. The company will invest $5.5 billion in facilities that will house 8,100 workers at the megasite, which is located adjacent to Interstate 16 near Ellabell.

Stripping hydrogen from natural gas and burying the CO2 byproduct. Yes, it's a thing.

In the spring quarter, several projects that strip hydrogen from natural gas while burying the unwanted CO2 in the ground became a reality. One such project, Enbridge near Corpus Christi, Texas, will invest $3 billion to transform natural gas into hydrogen — a cleaner energy source that’s in demand globally. While this process of generating hydrogen is now commonplace, it's importance to the overall health of our energy needs has not received nearly enough attention.

Boeing moving headquarters from Chicago to Arlington, Va.

Aviation and aerospace giant Boeing is moving its headquarters to the D.C. region in Arlington, Va. The relocation will include the CEO and CFO moving from Chicago to Virginia in order to be closer to the defense industry at the Pentagon.

Mississippi governor signs state’s largest income tax cut

Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. Gov. Tate Reeves signed a bill that will reduce the state income tax over four years, beginning in 2023. Mississippi is one of the poorest states in the nation and has struggled with underfunded schools and keeping rural hospitals open. The governor and other state officials believe the tax cuts will generate new economic growth and attract new residents.

In a pandemic world, supply lines are locating closer to end users

Mexico is in prime position to repair supply chain issues in North America. According to multiple reports, China is still the manufacturer to the world, accounting for 28.7 percent of global manufacturing output in 2019. But after a pandemic, a trade war and rising wages in China, many manufacturers have been looking for other options. One increasingly strong location is Mexico, when compared to the long-term obstacles presented by China to supply the world. For years, it took 21 days for merchandise from China to arrive at California ports. Today, it takes 159 days.

Setting up shop in Mexico

MGA Entertainment is keeping its U.S. factory and its relationships with its Chinese factories, but it recently opened two factories in Juarez, Mexico, and is about to open a third. Many companies are increasing their presence in Mexico.

One of the factors is the previous administration, which stopped immigrant workers coming to the U.S. Most employers of immigrants in this country find they are good workers, honest and willing to do work American laborers will not do, such as farm or some factory work. And we are still in an active trade war, with 25 percent tariffs on everything we import from China. Products from Mexico do not have those tariffs.

There are other reasons to move your supply chain to Mexico to serve the U.S. and Canada. Some companies are actually reshoring from Asia to Mexico to supply Asia. After all, Chinese wages surpassed Mexican wages in 2014. These Mexican advantages can actually make it profitable for some companies to supply clients and their plants in Asia after making the move to Mexico.

Volkswagen sells out of electric cars in the U.S. and Europe

Volkswagen sells out of electric cars in the U.S. and Europe

As a result of soaring demand and a current limit on capacity, Volkswagen has sold out of its EV allotment this year. The German automaker has ramped up production of EVs, but has sold out of electric cars in the United States and Europe. “We are not sold out because we can’t build cars. . .we are really sold out of electric cars because demand is higher than expected,” CEO Herbert Diess said in an interview in May. VW has a backlog of 300,000 EV orders in Western Europe alone.

The automaker is also considering another electric vehicle plant — a third to boost EV capacity — that most likely will be built at its manufacturing hub in Chattanooga, Tenn.

Florida had more deaths than births last year

It’s official in Florida... a larger number of workers are aging out and retiring than there are births. According to Neel Kashkari, President, Federal Reserve Bank of Minneapolis, there are only three solutions to a situation where less people paying for Social Security and other safety nets can be improved: (1) Accept slower growth; (2) subsidize fertility and (3) embrace immigration. The year 2021 is the first time since 1937 that the U.S. population grew by fewer than one million people, “It is just math,” according to Kashkari.