Where is the Tea Party segment of the Republican political agenda that was so prevalent just a few years ago? The “Taxed Enough Already” crowd seems to be in hiding as advanced economies in the world, such as the United States, have seen debt rise to 128 percent of global domestic product as of this summer, according to the International Monetary Fund. Countries throughout the world have boosted spending as they battle the coronavirus. But none have spent more than the United States.

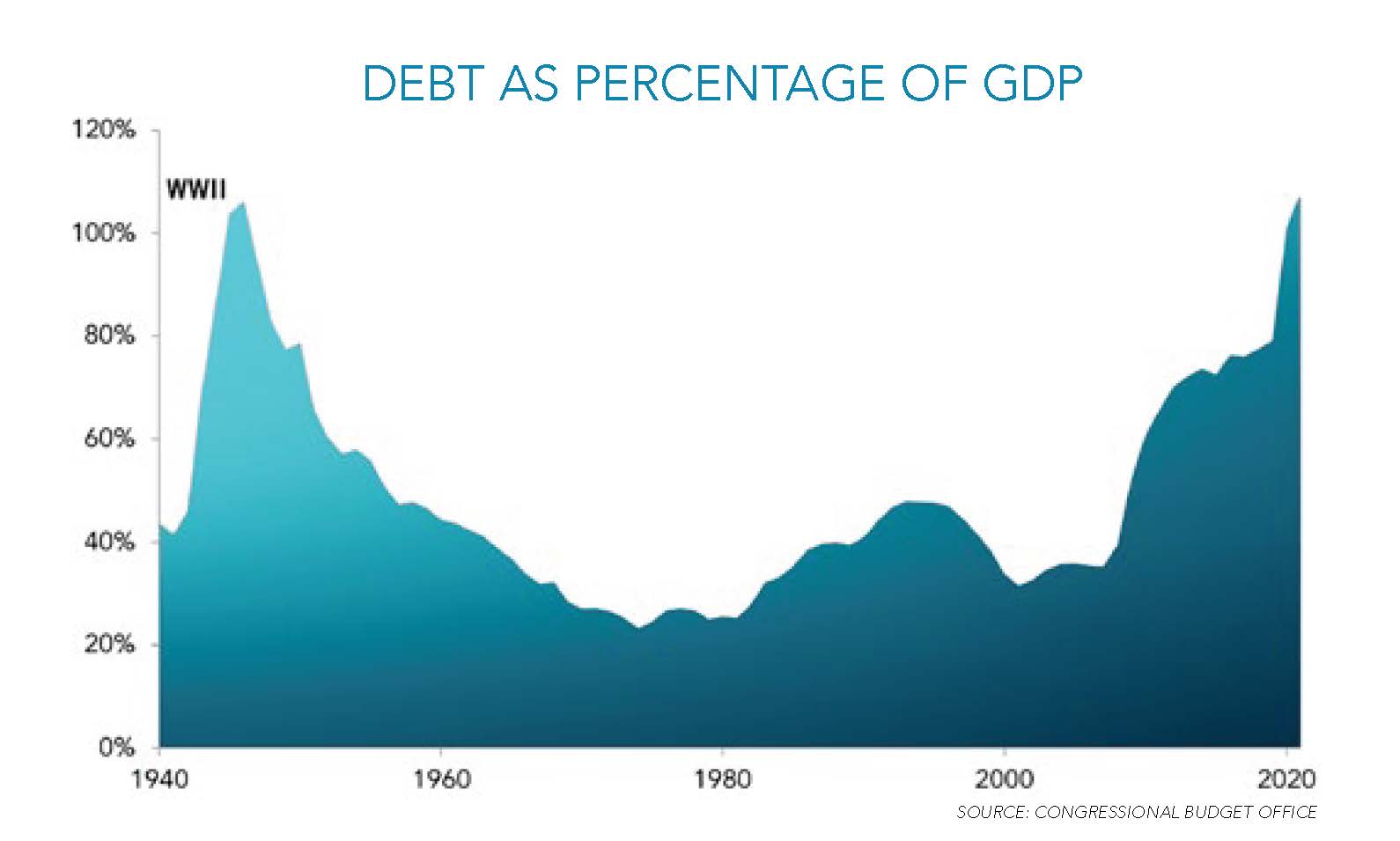

As countries worldwide spend with no end in sight to battle the virus, government debt has soared to levels not seen since World War II in the 1940s or the New Deal in the 1930s. So, we are talking the highest national debt since the last world war, or 75 years ago, when U.S. debt ran up to 118 percent of GDP.

During the Great Recession — the worst recession post World War II (until the coronavirus) — the federal government under President Barack Obama spent about $1 trillion in stimulus and bailouts of financial institutions and automotive companies. So far, the money spent in response to COVID-19 is about $2.35 trillion, or an average of just shy of $20,000 for every household in the nation. And the federal government, specifically the Federal Reserve, has spent an additional $4 trillion in stimulus and debt payments to battle this current recession. That’s more than $6 trillion in fed money in less than one year, or more than six times the federal stimulus of the Great Recession. It’s a historic total.

Speaking of historic, in an effort to save jobs through the Paycheck Protection Program this spring and summer as a result of the economic shutdown because of COVID-19, the debt of the United States now exceeds the size of the nation’s gross domestic product. Numerous economists for years believed that when debt through borrowing exceeded GDP, the U.S. economy would struggle as taxes, inflation and interest rates would naturally increase dramatically. So far that has not happened.

However, the Congressional Budget Office reported in 2010: “Large budget deficits would reduce national saving, leading to higher interest rates, more borrowing from abroad, and less domestic investment — which in turn would lower income growth in the United States. If policymakers are to put the nation on a sustainable budgetary path, they will need to let revenues increase substantially as a percentage of gross domestic product, decrease spending significantly from projected levels, or adopt some combination of those two approaches.”

During this coronavirus, “decrease spending” is either not an option or is simply not what this administration believed had to be done. We’ve had tens of thousands of businesses close. Without trillions invested in the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Paycheck Protection Program, tens of thousands more businesses would have closed and millions more people would have lost their jobs. And that is not a black and white (open or close) situation. Many businesses, according to the U.S. Chamber of Commerce, are only partially open as of this May (34 percent). The Chamber’s report cited that only about half of all businesses were fully open in May.

Most economists believed U.S. debt exceeding the size of the economy would not happen for years, or until about 2030. Yet, the coronavirus changed all of that. In late June of this year, the U.S. borrowed trillions to keep small businesses open and signed off on unemployment insurance expansions. Let’s face it, during the lockdown and the economic collapse that followed, the U.S. borrowed more money than at any point in the nation’s history.

Today, there is sentiment among some economists that with nearly zero interest rates, the U.S. can accommodate even more debt without serious consequences, such as high inflation or much higher taxes for all. After all, debt ratios above 100 percent of GDP can actually increase. If the virus continues or grows, there is no question increasing debt is on the horizon in the form of further bailouts of companies and citizens. If the virus continues unabated, or gets worse, the federal government will have to choose between a second bailout of small and large businesses, or watch unemployment skyrocket from 20 to 30 million unemployed to perhaps 40 to 50 million unemployed.

If you think social unrest is bad now, wait until double the amount of people have no income. So, will the fed choose to send out another stimulus to businesses and the unemployed just to keep the unrest at a minimum? If that is the case, expect more and more debt for the United States.

U.S. debt above U.S. GDP is certainly a new thing for this economy. Then again, so is the virus. I have done many interviews about this virus. I could sum all of them up in one sentence: “The economy all depends on the virus.” In other words, “Who knows what is going to happen?” But we can certainly debate the subject, which is what this article is all about.

Here are the totals: At the end of 2019, the United States was approximately $17 trillion in debt, or about 80 percent of gross domestic product. Of course by June, the economic lockdown reduced GDP dramatically. And with the fiscal stimulus in the trillions, debt rose to $20 trillion, or about 106 percent of gross domestic product. Move forward one month and the nation’s debt has reached 120.5 percent of economic output, or $26.5 trillion. That figure is not sustainable. That figure is higher than at any time in the nation’s history, even during World War II, the last time the U.S. was in this kind of debt. The average debt-to-economy ratio in the nation’s history is 30.3 percent, or about a quarter of what it is now.

These are certainly trying times for not only the federal government, but individuals, families and businesses alike. Risks are ripe all across the board. The Paycheck Protection Program doled out trillions in loans, many of which are forgivable loans to small businesses. Not only will many of the loans not be repaid, many of the recipients may not be in business by the fall if there isn’t another stimulus. It was the Fed that guaranteed those loans. The Federal Reserve did something similar in 2008. However, back then the central bank did not lose money, it actually profited off of the loans.

What are the drivers of this incredible U.S. debt?

Other than the coronavirus crisis, the main drivers to national debt are increased spending on social programs and interest costs on the national debt. Social programs have grown from 20 percent of federal expenses in 1959 to 62 percent in 2018. With the virus shutting down the economy this spring, you can add to the social programs costs because there is nothing more “social” than bailing out businesses and households. That 62 percent is likely much higher today. Without reforms, social debt will eat up this country at some point.

Some blame tax cuts as a main driver to national debt. But that is not really true. Taxes as a portion of Gross Domestic Product have remained fairly level for 80 years in the United States. Sure, we’ve seen taxes raised, somewhat dramatically in times of war or under the New Deal. But for the most part, taxes have remained stable for decades.

Furthermore, GDP in the last eight months has dropped dramatically because of government-mandated shutdowns, especially those in the service sector such as restaurants, bars and retail. Much of that data has not even been recorded as of yet.

While some economists maintain high debt is not a problem for countries that control their own currency in an age of nearly zero interest rates during borrowing, excessive government debt can result in weak economic growth, lower wages, inflation, tax hikes and reduced government benefits. Just look at the Great Recession of 2007 to 2009. Wages were still down from that period of high U.S. debt. Now that debt is higher than ever. While we have seen hardly any signs of inflation over the last 10 years until this summer as food prices rose, we have seen much lower wages over the past decade.

In 2015, I was speaking to a group in Panama City, Fla. Wages between 2009 and 2015 grew by such a paltry sum. I was asked in the question and answer segment after my speech about unions. I have steadfastly been against unions. However, my answer to the question was, “If wages don’t increase substantially in the next few years, I might be pro-union.”

About those social benefits

The $25 trillion in U.S. debt does not take into account commitments to Social Security, Medicaid and Medicare. Those three federal programs are projected to run deficits of $82 trillion over the next 30 years. Some of the biggest issues with Social Security and Medicare are (1) health care costs are rising so fast that Medicare recipients are receiving three times their lifetime contribution; (2) Baby Boomers — the largest generation in this nation’s history — are aging out of the workforce (74 million); (3) the birthrate is at its lowest rate in U.S. history. Therefore those aging out cannot be replaced, meaning the Baby Boomer’s payroll taxes cannot be replaced. The only way we can bridge that gap is to increase immigration from about 200,000 last year to 3 or 4 million.

Social Security is mainly funded through dedicated payroll taxes. The dedicated payroll tax is 12.4 percent and those dollars are evenly split between employers and employees. President Trump wants to cut payroll taxes. That would be a disaster in an election year.

A poll by PBS, NPR and Marist in 2018 showed that 60 percent of those polled do not want cuts to Social Security, Medicaid or Medicare. They would prefer to bring back the taxes that were cut in 2017.

Some sectors are thriving in this pandemic

During this pandemic, business is booming for some businesses. Top gaming companies like Nintendo, Electronic Arts and Activision Blizzard are seeing sales bloom. The more people that stay home during this virus the more gaming companies are selling their software.Sanitizing and cleansers in general are racking up. This spring, sales of aerosol disinfectants jumped 230 percent and multipurpose cleaners rose over 100 percent as a result of the coronavirus.

At-home workout devices have also seen a strong jump in sales. Companies like Pelaton have seen double-digit increases in sales.

As people continue to bypass bars and restaurants, grocery stores like Publix and Kroger are making a killing as they are deemed essential businesses.

Makers of personal protective equipment are booming. Sales of gowns, masks and other PPE have seen triple-digit increases in sales. Home furnishing retailers like Wayfair are also seeing sales over 100 percent as people stuck at home do room makeovers.

Since so many people continue to work remotely, communication tools such as Zoom and Slack have added on average an increase of 80 percent of users. Zoom reported that its video conferencing tool is used by over 300 million meeting participants a day.

Distribution and delivery services have also grown during this pandemic. Amazon is hiring 100,000 workers in the U.S. and Canada to keep up with the growth.

Higher taxes for millionaires and billionaires as a revenue producer? Or pitchforks?

As written, the coronavirus has added $6 trillion in debt and that is just so far this year. Politicians asking for more tax cuts are short-sighted. One way we can raise revenue is to tax those in the top 1 percent of annual income. In fact, many wealthy people are begging the country to do this to fund coronavirus relief.

Earlier this year at the World Economic Forum, a group called The Patriotic Millionaires, a collection of wealthy people who support raising taxes on the rich, called for international tax reform. In a great story on CNBC in January 2020, the author wrote, “In a letter the group plans to release Wednesday, the Patriotic Millionaires will call for international tax reform. Previously, the organization has focused its message on the United States, where it has lobbied in favor of a millionaire tax and against tax loopholes for investment funds.

“The letter, titled ‘Millionaires against Pitchforks,’ warns that tax evasion has ‘reached epidemic proportions’ and contributes to ‘extreme, destabilizing inequality.’ It is timed to land as millionaires and billionaires gather here for the World Economic Forum — which the group’s president, Erica Payne, calls ‘one of the most obnoxious displays of privilege that is found on the world stage.’

“‘There are two kinds of wealthy people in the world: those who prefer taxes and those who prefer pitchforks. We, the undersigned, prefer taxes,’ the letter says. It is signed by 121 people, including Disney heiress Abigail Disney, Celtel founder Mo Ibrahim, former Unilever CEO Paul Polman and ‘Love, Actually’ filmmaker Richard Curtis.”

In winter 2016, Southern Business & Development’s feature story was titled, “Wages, Riches and Pitchforks.” Here is part of it: “Not all right-leaning capitalists are against raising the federal minimum wage. Entrepreneur Nick Hanauer, a self-proclaimed plutocrat and founder or financier of over 30 companies, sees a future of angry mobs with pitchforks in this country if something isn’t done about income inequality. Hanauer explains in one of his TED Talks, ‘While people like us plutocrats are living beyond the dreams of avarice, the other 99 percent of our fellow citizens are falling farther behind.’

“Hanauer continued by saying, ‘You see, the problem isn’t that we have some inequality. Some inequality is necessary for a high-functioning capitalist democracy. The problem is that inequality is at historic highs today and it’s getting worse every day. And if wealth, power and income continue to concentrate at the very tippy top, our society will change from a capitalist democracy to a neo-feudalist renter society like 18th century France. That was France before the revolution and the mobs with the pitchforks.’

“Hanauer claims there is no evidence to support the theory that if low wage workers earn a little more, unemployment will escalate and the economy will collapse. In his TED Talk, he also claims that Seattle (his hometown), which voted to raise the minimum wage to $15 per hour by 2017 for some companies, has not seen negative effects from having one of the highest minimum wages in the country. ‘If trickle-down thinkers were right, then Washington State should have massive unemployment. Seattle should be sliding into the ocean. And yet, Seattle is the fastest-growing big city in the country,’ Hanauer maintains.”

States and communities and bailouts

While the coronavirus has seen record aid given out to individuals, families and businesses, there has been little given out to states and communities, which are in dire straits as tax collections have cratered and unemployment insurance has skyrocketed. There are some states where the unemployment insurance fund is nearly exhausted. If unemployment continues at this rate, those states will then have to borrow from the Federal government to replenish their unemployment insurance coffers. Some GOP lawmakers have suggested a package for states that totals around another $1 trillion. House Speaker Nancy Pelosi says that’s not enough to secure financials for states given what they have lost over the last eight months.

Treasury Secretary Steven Mnuchin and President Trump have made bailing out the states a political issue. They both have said they will not bail out “blue” states and cities that have “mismanaged their economies.” In fact Trump said in a New York Post article, “because all the states that need help — they’re run by Democrats in every case.

“You look at Illinois, you look at New York, look at California, you know, those three, there’s tremendous debt there, and many others,” Trump said. The president also tweeted in May, “Well run States should not be bailing out poorly run States, using Coronavirus as the excuse! The elimination of Sanctuary Cities, Payroll Taxes, and perhaps Capital Gains Taxes, must be put on the table. Also lawsuit indemnification & business deductions for restaurants & ent.” Again, payroll taxes fund Social Security.

New York Gov. Andrew Cuomo countered by listing the states that send the most tax revenue to the Federal Treasury — the top five: New York, New Jersey, Massachusetts, Connecticut and California, respectively.

The borrowing machine

The coronavirus pandemic has caused economic disruption. However, many Americans don’t seem that concerned about the massive deficit the virus has created as social programs such as food stamps and unemployment insurance exploded.

In a Pew Research Study conducted this summer, under half of U.S. adults (47 percent) felt that the deficit was “a very big problem,” even though the deficit accounts for about half the total of federal spending. Other issues in the study that were found to be a “very big problem” were ethics in government (63 percent); the pandemic (58 percent); climate change (40 percent); and illegal immigration (28 percent).

To give you an idea of how hard the coronavirus hit the U.S. economy and Treasury, in the first 10 months of fiscal 2020, the federal government took in $2.82 trillion in revenue and spent $5.63 trillion, according to the Bureau of Fiscal Service. From April to July, revenues were down 9.8 percent from the same period in 2019, and you can see how much deficits swelled. All of the deficits require the U.S. to borrow money from a variety of sources, including China. So, let’s get this straight: the U.S. borrows trillions each year to pay its debt of the previous trillions it has borrowed.

If we do not see a sizable turnaround in the economy by the end of this year, the federal budget deficit will surely take a bigger bite out of the economy. As the federal government spends more on interest on the debt, there will be less available for other programs, such as benefits for social programs. Then again, as I mentioned earlier, “It’s all up to the virus.”

But there is good news

The 10-year recovery that ended in February was the longest on record in the United States. Foreign nations, for the most part, did well during those 10 years as well. This created a world that saw savings increase dramatically in those 10 years. Big investors love to invest in U.S. Treasuries, and that includes foreign governments. This enables the U.S. Treasury to borrow more at relatively low interest rates to service existing debt. In response to the recession, the Fed is buying Treasury bonds from investors, including foreign governments who have provided money to the U.S. via loans.

So can the Fed just keep printing money to pay for what the government owes in these coronavirus times? Not in this situation. There are just too many people out of work, too many businesses that have closed and not enough tax revenue. But for now, I believe another round of stimulus — the fourth — in this virus can and will happen. In fact, it is probably a foregone conclusion that at least another trillion dollars will be ushered out to businesses and citizens. Then it will be up to the virus, not the Fed.

Conclusion

There is no question we will need to shore up our social programs. But how? We could raise payroll taxes to help fund Social Security. We could also raise the full retirement age. The budget deficit of $26 trillion and $82 trillion in social program deficits cannot be ignored any longer. Policies must change. The U.S. debt is the most acute in the nation’s history. Certainly during this virus, the debt and Gross Domestic Product are headed in opposite directions. That can only go on for so long.

While this is a good time for the federal government to borrow because of low interest rates, the amount of debt we already have has surpassed the value of the entire U.S. economy. That has never happened before except during World War II. While we might be in a major war with an unseen enemy (the coronavirus), actual military wars currently being fought are nothing like World War II. Perhaps we could reduce our military budget of about $750 billion each year.

Millennials are not having babies. They don’t think they can afford them after the Great Recession, and now we’re hit with the coronavirus. With Baby Boomers retiring by the millions each year, and with U.S. debt at its highest in history, this situation is not sustainable. At some point in the near future, the U.S. will have to deal with rising federal debt. As for today, the U.S. debt and its economy are up to the virus.