Editor’s note: This section titled “SouthBound” is usually reserved for a short opinion piece or humorous story written by me. But since our series of the “Southern Economic Development Hall of Fame” runs so long and has taken the place of the last three covers with three more to go, we have used the SouthBound space for one of our regular features.

On October 8, 2025, I sent out the pre-release (partial) of the following report on project activity to all 13 heads of state economic development agencies in the South. I received some political blow back. I have been doing this so long; it is not like I did not expect it, especially in this political environment.

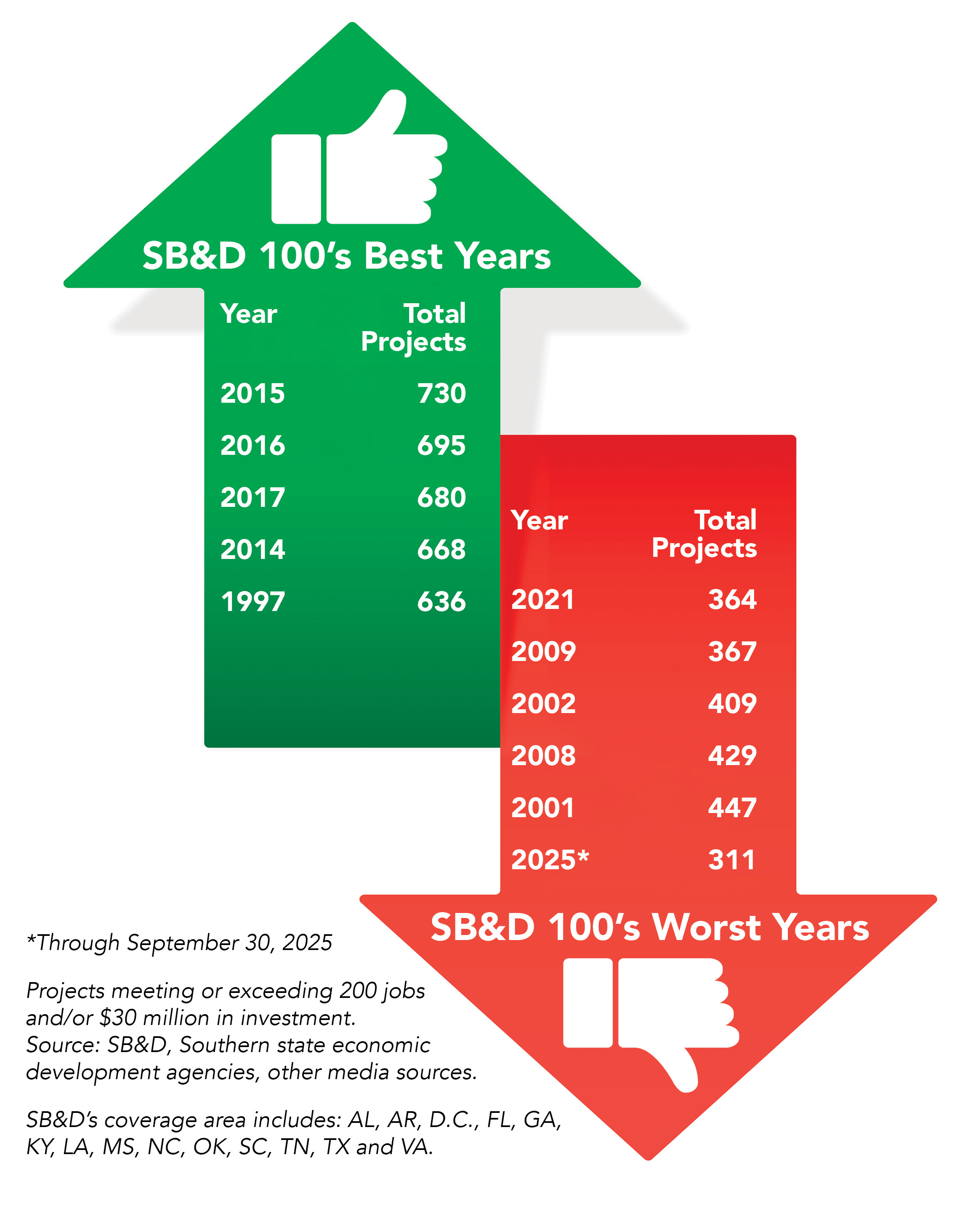

Let it be known that prior to this year — and the year is not over yet — the two worst years of the SB&D 100 in 33 years of its history were in 2021 and 2009. I had to look it up because I did not know.

President Joe Biden, a democrat, was the president in 2021 (the worst SB&D year yet) and President George W. Bush (red) and President Barack Obama (blue) were the presidents when the 2009 SB&D 100 was published; the second-worst Southern economic development deal count year in 33 years.

As professional journalists for more than five decades, all we do is look at the data and then comment on it.

The following report is not a political statement and even more, the report is not complete as of yet. The final 2025 SB&D 100 report comes out in February of 2026.

Again, we just count this stuff up. Please understand there are no political implications in this data, there never have been and there never will be.

I am not really sure what to make of the first three quarters of 2025 regarding our coverage of economic development activity in the third largest economy in the world, the American South. In fact, I am not sure where to even start because there are so many departures from the norm — and we know the “norm” because we have had the same rules and methodologies in place with our annual SB&D 100 for 33 years now — and so far, 2025 can be best described as “freaky.” And most of it is not freakin’ good. Yet, there are still some good things happening.

But that is up for interpretation. I am not an economist. I am an economic development journalist. We just look at the data, that’s all.

Let’s start with this introduction before getting into more detail about the matter, shall we?

We have set up a “Freak-O-Meter” level of 1 to 10 for each economic category covered in this article based on how “freaked out” we have been by the numbers relative to our beloved South’s economy that we have collected so far this year.

The rules of this report

If we are not freaked out at all by these data points and events in 2025, that earns a score of say, 1 to 4. Somewhat freaked out and you will see a score of between 5 and 8. Totally freakin’-freaked-out — good or bad — by this data earns a score of 9 to 10+.

You will understand this process by reading on. Remember, “freaked out” can be positive, negative or have neutral connotations, according to A.I. You are about to read about all three definitions in different forms.

Category: Deals announced in the South

January 1-September 30, 2025

Project counts are on course for what could be the worst year ever in SB&D 100 history, which goes back to data collected in calendar year 1993. This includes all years during the Great Recession (2007-2009 and 2010 was no picnic), the recession of 2001, as well as the two years (2020, 2021) of COVID-19. Yes, we are freaked out that big deal counts are this low nine months into 2025 and that they are being compared to those years.

As of the end of the third quarter, there have been 311 publicly announced (by a corporate representative or state agency) manufacturing and service projects in the 13 Southern states and the District of Columbia, meeting or exceeding 200 jobs and/or $30 million in investment so far in 2025.

Those are extremely low project numbers to date this year. Historically, we have only seen those numbers while in a recession, a year after a recession, at war or during a pandemic.

The freaky thing about all of these numbers is the U.S. is not technically in a recession. Well, you could have fooled us, because if we are not, by definition, in a recession (at least three straight quarters of negative GDP), we sure are in the “Great Southern Economic Development Recession of 2025.”

Comment: Again, these low numbers have never been seen in 33 years except during recessions and a pandemic. What is really freakin’ scary is this year might not total the projects meeting our four-decade-old thresholds captured in any of the Great Recession years. However, we will add that September was the best month of the year and let’s hope that momentum continues. In fact, September can be compared to a “normal if not very good month” compared to previous years, with nearly a third of all deals so far in 2025 being announced in September by a company representative or a Southern state agency.

It is going to be interesting to see if this year settles around the two worst years ever — 2021 (COVID) and 2009 (Great Recession) — or somehow at least reaches the 400-deal mark, which you can see in the “Best Years” and “Worst Years” charts.

The two worst years saw 364 projects meeting our thresholds (2021) and 367 (2009). The numbers from 2002 weren’t exactly our shining moment either (9/11, Afghanistan war and in 2003, the invasion of Iraq).

Category: A dearth of projects coming from the South’s two largest job and investment industries

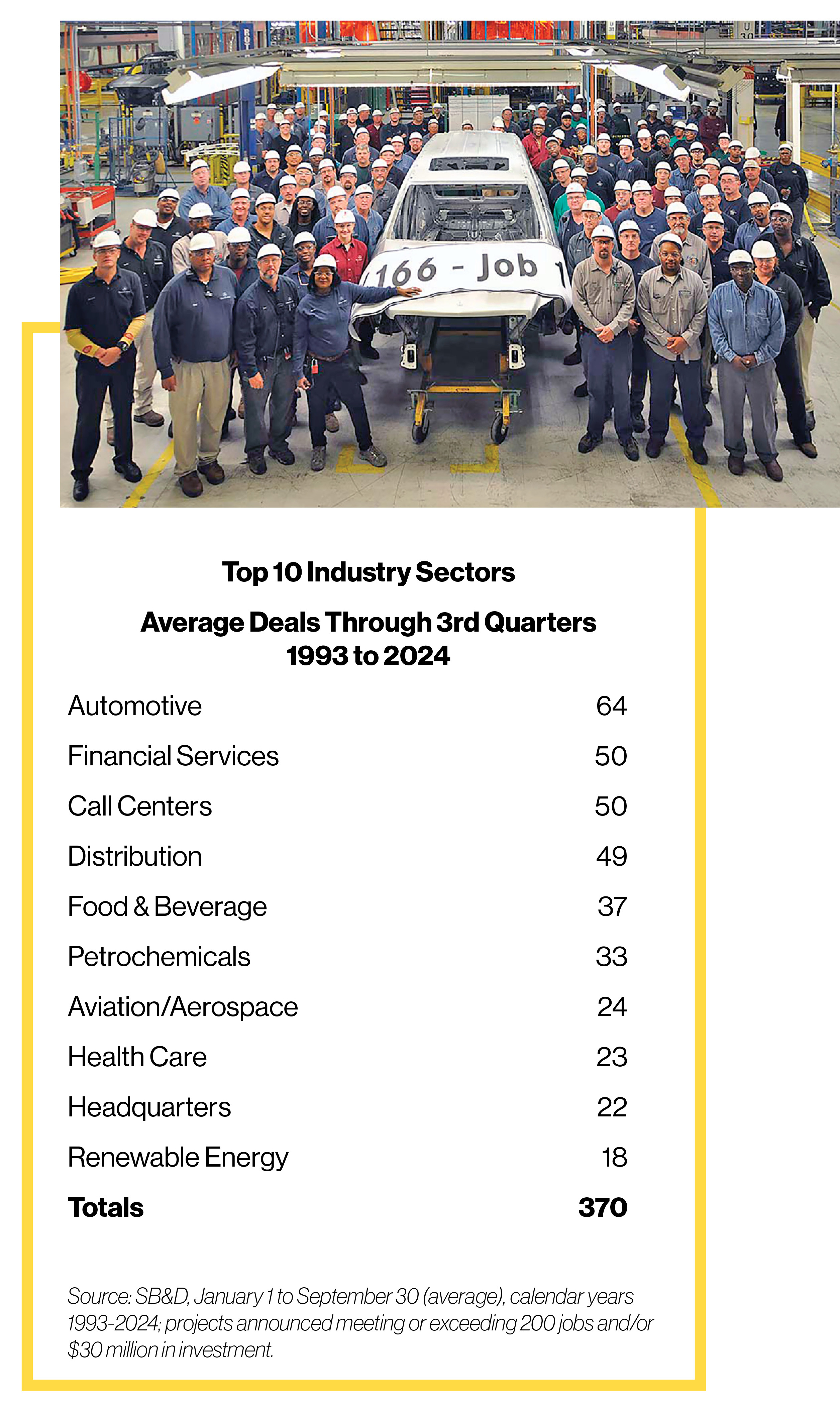

After three quarters of 2025 in the books, we have witnessed an almost total collapse of projects coming from the South’s two most reliable industry sector job generators — financial services and automotive.

When the automotive and financial services industries decide to essentially write the year off in the same year, the South goes south in project counts. Not one year in 33 years have we seen numbers — or lack thereof — like these in captured projects from the Southern Automotive Corridor except in the domestic automotive bailout of 2008 and 2009. Yup, this is one freaky year.

Most years, automotive accounts for anywhere from 75 to 100 projects on average and has each year for a long time. The best year ever was in 2015 when 111 automotive projects of 200 jobs or more were announced.

The EV and battery years from 2021 to 2023 were pretty good, too. As for 2015, we can only guess that those results were from pent-up demand as well as from automakers repatriating assembly plants after the Great Recession due to demand.

In short, automotive has accounted for around a fifth of all large deals meeting or exceeding our thresholds on average each year since 1993. Automotive is the South’s “Big Kahuna,”

and I predicted it in 1993, or so said one Southern economic development legend, J. Mac Holladay.

“Michael C. Randle sees things 15 to 20 years before we do and we are pretty damn smart. His prediction that the Southern Automotive Corridor would take down Detroit was laughable when he wrote it in his media properties in 1993. He was right!” — J. Mac Holladay, CEO, Market Street Services

(Hey, I own this joint so don’t freak out by me tooting my own freakin’ horn when I get the chance.)

Who is hurting in this automotive downturn?

It should be noted that the rural South is home to more automotive suppliers than urban or ex-urban combined. There are hardly any run-of-the-mill, bread-and-butter supplier deals out there so far in 2025 — EV or combustible. You know the ones, a $65 million, 200-job stamping project? A nice car seat or tool-and-die deal. Those have been no-shows in the first three quarters of 2025 for the most part.

Then again, most in the EV and battery-run developments from the Inflation Reduction Act of 2021 to 2023 landed in rural locales in the Southern Automotive Corridor. So, while several of those projects have been delayed, infrastructure is already in place, giving the rural South what we still believe is a bright future in automotive.

In the first three quarters of 2025, we have counted 27 automotive projects of 200 jobs and/or $30 million or more in investment. The average nine-month total over the last 33 years is 63.5 automotive projects. That is freaky!

Financial services are always on the sidelines in a tough economy

The financial services industry is performing even worse than automotive, which is typical of a recession. But, again, we are not in recession.

I think so far, some of the economists that predicted doom and gloom regarding the tariffs were a little off. Then again, we may just not yet be to the point where tariffs restrict trade dramatically and prices go up even more.

I mean, can you believe we have counted just 13 big financial services deals to date in 2025? That boggles the mind and you can look directly at two huge financial services states as the source of the financial deal meltdown — Florida and Texas.

Then again, Florida and Texas are two states where getting complete deal information is almost impossible. Of all the states, those two state economic development agencies have been in flux for years now. Chalk that up to mega-markets being able to do their own thing without state intervention. Many times, we can get better data from the locals in places like Dallas-Fort Worth, Tampa Bay, Houston and Miami than what those two states offer up to media like SB&D.

Thirteen deals in three quarters of this year come from financials, and that includes a range of projects coming from banks, insurance and mortgage firms, fin-tech and bit coin. These are the worst freaking numbers coming from financials ever, except in 2009 when there were five deals meeting our thresholds for the entire year. That’s right; five projects at the height of the Great Recession from financials.

Thirteen deals in three quarters of this year come from financials, and that includes a range of projects coming from banks, insurance and mortgage firms, fin-tech and bit coin. These are the worst freaking numbers coming from financials ever, except in 2009 when there were five deals meeting our thresholds for the entire year. That’s right; five projects at the height of the Great Recession from financials.

Comment: If you want to blame two industry sectors for the so-far-to-date slow deal year, put it on the automotive and the financial sectors. And it is not even close. Even in the Great Recession, there was some activity from financials and automotive, sans 2009.

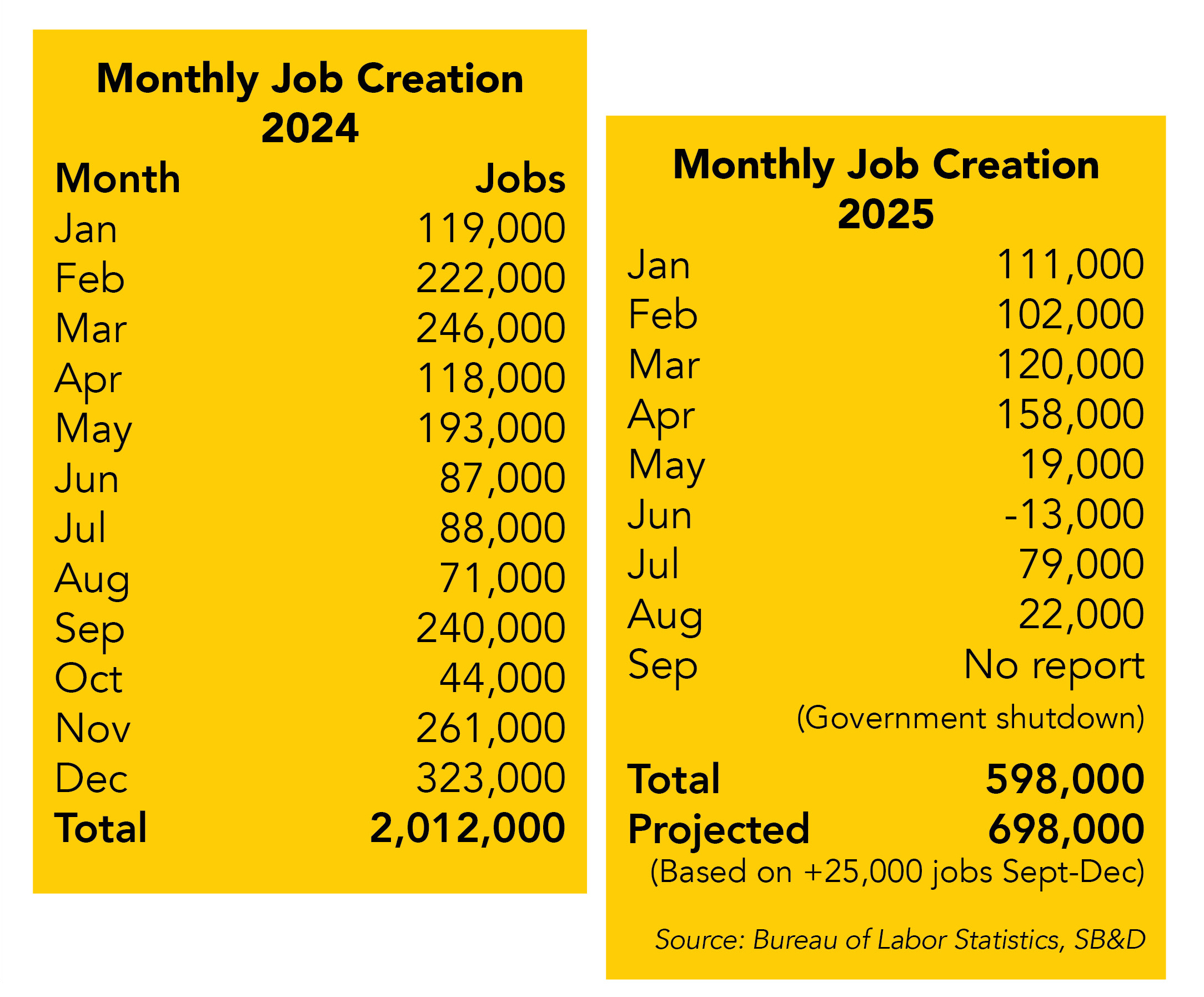

Category: Job creation so far in 2025

Category: Job creation so far in 2025

We don’t typically run the same chart twice in a single issue, whether it be found in the print product of SB&D, or the website SB-D.com (which has been live in various forms since 1998. SB-D.com will be retired next year and replaced by SouthernBusiness.com). But it is important to note the lack of job generation in the U.S. right now. I will leave it up to the economists to tackle that one.

Comment: The issue is something we have been talking about for years now. As a result of the lowest rate of child births in U.S. history, so many Baby Boomers aging out of the workforce, combined with massive cuts in every way an immigrant can enter and work in this country legally, as well as millions of workers being deported, the labor left in this country is simply non-existent.

So, we are not surprised job generation is slowing. There is hardly anyone out there that needs a job since we are essentially at full employment. However, keep reading about layoffs that are occurring this year.

Category: Layoffs are adding up

This is a subject that is not being covered much, except from some of the high-brow business media outlets and think tanks. But CBS News on October 2, 2025 (right at our deadline) published a headline that read, “Layoffs across the U.S. this year are at their highest level since 2020, new data shows.”

Through September, or the timeframe of this entire report, employers across the U.S. have cut nearly 950,000 jobs, the largest number of layoffs since 2020, according to a report by outplacement firm Challenger, Gray and Christmas.

In the CBS piece, Aimee Picchi wrote, “Jobs cuts could surpass 1 million in 2025, the group forecast.” I find that a somewhat flawed statement, in that with 950,000 layoffs already at the three-quarter mark, that is an average loss of over 105,000 jobs per month, permanent and temporary. If that continues, the U.S. will easily surpass the 1 million mark in layoffs by January 1, 2026.

During the 2020 COVID year, we all remember the businesses that shuttered across the nation. By the end of the third quarter of 2020, there were 2 million layoffs in the U.S.

However, some of that data is sketchy as the Bureau of Labor Statistics was caught in the crossfire of what was the definition of a “permanent” layoff and what was a “temporary” layoff. “Temporary” layoffs soared to more than 16 million at the height of the pandemic. However, we know, most of those jobs came back and quickly.

And let’s not forget that federal jobs losses are not included in private industry layoffs. To date, it is estimated that federal job losses under DOGE this year are anywhere from 325,000 to 350,000. However, this administration has threatened to cut more federal workers during the government shutdown, calling them “mass layoffs.”

Yet, the headline by CBS News that “Layoffs across the U.S. this year are at their highest level since 2020, new data shows,” is frightening. I mean, just to be compared to COVID years in regards to layoffs is more than a concern.

Comment: So, with hardly any new jobs being created, layoffs spiking and deals cratering, this looks like a recipe for disaster. Yet again, it is not as bad as the numbers indicate. New job creation is a misnomer when the labor shed is bare. A spike in layoffs can be handled for a while.

Comment: So, with hardly any new jobs being created, layoffs spiking and deals cratering, this looks like a recipe for disaster. Yet again, it is not as bad as the numbers indicate. New job creation is a misnomer when the labor shed is bare. A spike in layoffs can be handled for a while.

But when President Trump’s tariffs were first mentioned early this year and before being implemented, we expected mass layoffs to occur. So, we are not “freaked out” by that statistic. It was expected, even though the doomers and gloomers were only about half right. Again, so far.

Category: What industries are hanging on or even thriving in the Great Southern Economic Development Recession of 2025?

In category No. 2 earlier in this article, we provided solid data that the South’s two largest industries, automotive and financial services, have tanked. That is okay for now. But if it continues into 2026, we will have a real problem.

But some new industries at the top this year, like data centers, A.I., metals, aerospace and pharmaceuticals, are actually propping up this freaky economy, at least enough to keep us out of recession. In fact, some of those sectors’ numbers are at or near record highs over four decades.

But some new industries at the top this year, like data centers, A.I., metals, aerospace and pharmaceuticals, are actually propping up this freaky economy, at least enough to keep us out of recession. In fact, some of those sectors’ numbers are at or near record highs over four decades.

So, while we will place the woeful numbers of automotive and financials in with these industry sectors’ deals so far meeting or exceeding our thresholds of 200 jobs and/or $30 million, we can clearly see a massive change in industry sector deal counts that make this year so freakin’ weird. Weird as in a changing of the guard? Our experience and intuition says it is too early to tell.

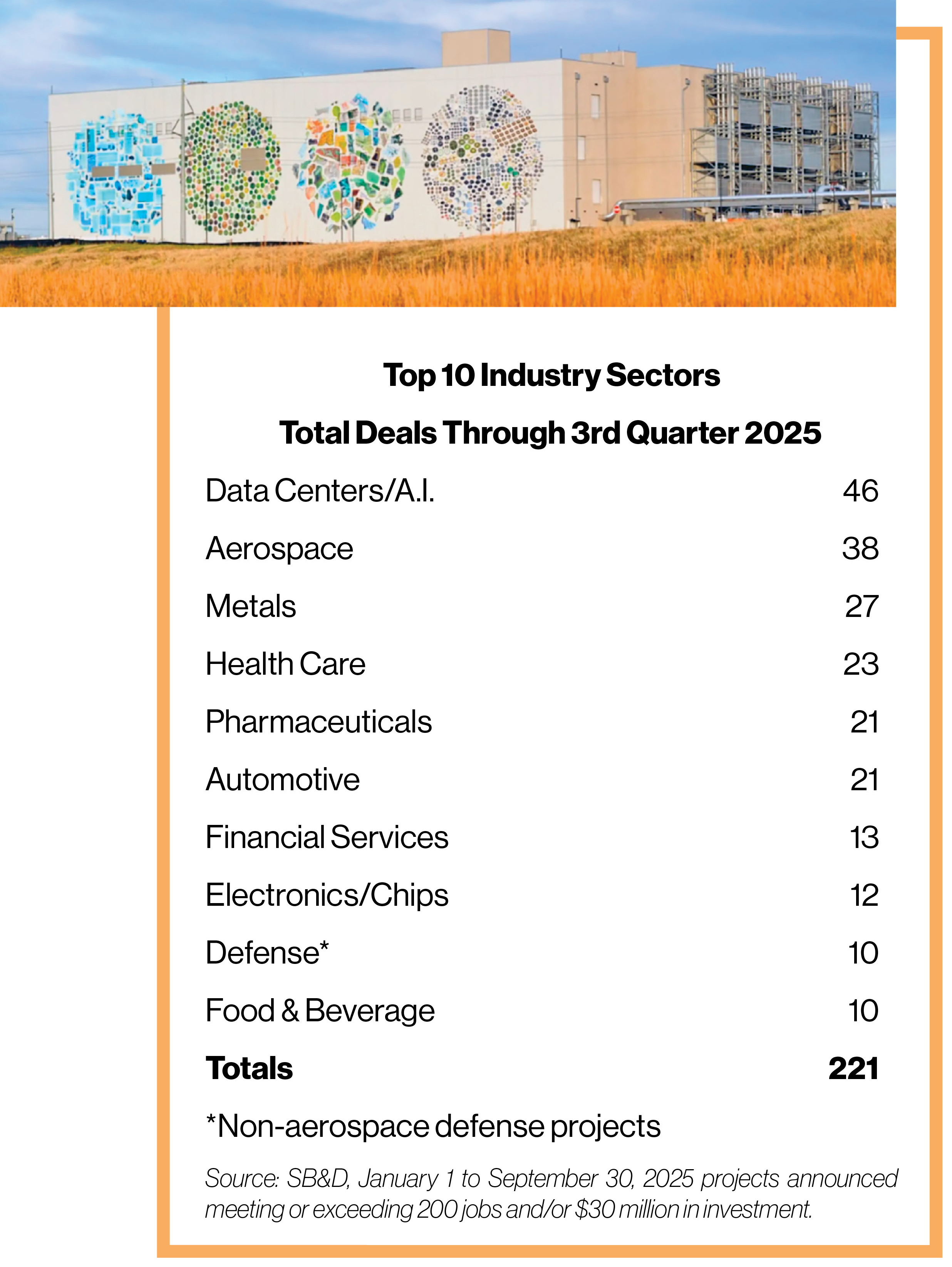

As you can see, the data center industry is dominating project activity through the first three quarters of 2025. That has never happened. In fact, in 2019, just five data centers made our list.

The problem is, and it goes back to the lack of job generation, data centers are great construction job drivers, but poor permanent job creators. The LNG and petrochemical industries are similar in that regard. With some of the biggest deals, 10,000 construction jobs are announced over time and 100 permanent ones.

Aerospace has had its best year so far since 2016, when 55 big deals were rung up in that year’s SB&D 100. But this year is not done yet. With three more months left to count, aerospace and aviation projects meeting our thresholds might set the all-time record since 1993.

Let’s just say that aerospace is having as great a year as automotive is not.

Now compare what a “normal” SB&D 100 “big board” over the last four decades looks like to the list of industry sectors above.

Now compare what a “normal” SB&D 100 “big board” over the last four decades looks like to the list of industry sectors above.

We have averaged out a typical year over the last 33 years and we did it by shedding any data on apparel, cut-and-sews and textiles, which were still going strong in 1993 (the first year of the SB&D 100) through 1998. That industry is gone and to date it is never coming back except in some high-end, boutique cut-and-sew forms. Also gone, for the most part, are those pesky, low-wage call centers.

Comment: Out with the norm, in with the freaks, both good and bad. Data center announcements are most likely to lead the deal parade in the South for 2025? Really?

Comment: Out with the norm, in with the freaks, both good and bad. Data center announcements are most likely to lead the deal parade in the South for 2025? Really?

Well, they were coming on strong in 2023 and 2024 in traditional places like Dallas-Fort Worth, Atlanta and NOVA (Northern Virginia, data center central). Then, some of those places didn’t want them anymore.

So, naturally, we now have huge data centers being built in the tiniest of hamlets, and many in some of the South’s smallest states.

And in some cases, two traditional power plants have to be built next to the data centers to power them. That is why you are seeing massive data centers building away from urban areas, once the dream location for these massive succubi (think the cartoon, South Park) of water and energy.

My intuition of 45 years of covering economic development thinks this run, the A.I. run, might turn out bad in the short term, or possibly at the end, maybe even in the middle.

Is it a bubble? Like the dot-com bubble of the 1990s? Then again, my intuition has been wrong before because I did not call the dot-com bubble when I had the chance.

For one, a lot of these data centers are being fast-tracked from the state contacts directly to the utilities. There is nothing wrong with that other than possibly a slight lack of transparency.

Another negative to me: A lot of these data centers don’t even bother with applying for incentives. What does that tell you? It tells you they are establishing these behemoths as fast as they can. My question is, why? Is the demand truly there? I don’t know.

At least we knew why the EV train of $250 billion in the Southern Auto Corridor from 2021 to 2023 had a real reason to fast-track; the deadlines from the Biden’s administration’s Inflation Reduction Act. It had a reasonable deadline, or a sunset.

Conclusion

The fact that September was the best month of the year in projects meeting our thresholds is encouraging. Maybe it sets the tone for the rest of the year and into 2026.

Again, though, the numbers are what they are. There is still time to salvage what is obviously a difficult year and I believe everyone will agree that few know completely the rules of this economy.

For hypothetical examples:

Is this lawsuit or the thousands before it part of the equation in deciding whether my company should invest and add capacity or not?

Will the tariffs change, because they seem to change every time the wind blows?

Is my workforce going to be here tomorrow, or is ICE going to take a good number of them away?

I have known John Bradley, TVA, Memphis Chamber, for a long time. At the first SEDR@WaterColor in January of 2014, John said this so eloquently to the group.

(Now, he was not talking about tariffs or lawsuits or ICE raids. He was talking about TVA’s incredibly successful certified megasites program. But the concern over “uncertainty” of large sites for industries directly relates to today’s economy.)

Bradley said, “We are really trying to advance sites to make sure these site selection consultants and companies that are looking in those areas are comfortable with the risk mitigation. In other words, they know what the risks are; they are comfortable that the risks have been identified and that they can deal with them.

“I mean the scariest thing about someone buying a site or investing in added capacity is what they don’t know.”

There lies the problem so far in 2025. We don’t know what’s next.

And that freaks me out.