On November 10, 2021, EV startup Rivian — backed by investments from Amazon and Ford Motor Co. — became public through an initial public offering (IPO) and began trading on the NASDAQ under “RIVN.”

After its first day on the market, RIVN closed at $100.73 per share for a $100 billion valuation. As of mid-April of this year, Rivian’s stock had plunged to under $10. Its lone products are two electric SUV models made in Normal, Ill.

In December 2021, Rivian announced that it would build a $5 billion plant east of Atlanta along I-20 in southern Walton and Morgan counties that would house thousands of workers.

The Rivian project was one of the first startups out of the electrification blitzkrieg that has fallen from the skies on the Southern Automotive Corridor, as the region leads the way in EV and EV-related investments in all of North America.

Yes, the South has captured more next-generation mobility (EV) investments than all of Canada, Mexico, the Northeast and the West combined in just four years.

Detroit and the Midwest are competing with the South in these electrification investments, but they are substantially behind at this point. The Southern Automotive Corridor, at least out of the gate, can be compared with American Pharoah, the thoroughbred that won the Triple Crown and Breeders Cup in the same year. The rest of the world, so far, is eating Southern dust at this point.

Some of those greenfield EV projects announced in the last four years, such as Ford’s BlueOval City north of Memphis and its battery plant in Hardin County, Ky., Hyundai’s metaplant near Savannah and Toyota’s battery facility in Randolph County, N.C., are going well. Some, specifically the startups, are not going so well. And let’s not forget, one of the largest (if not the largest) electric vehicle plant in the world is located in Austin, Texas. That would be Elon Musk and Tesla.

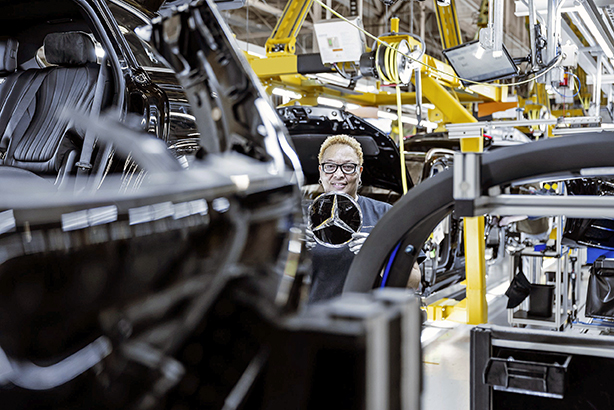

Some existing combustion engine plants that have already designed and implemented new EV assembly lines also seem to be getting off to good starts, including Mercedes and Hyundai in Alabama, BMW in South Carolina, Nissan in Tennessee and others such as GM near Nashville and Toyota in Kentucky.

Rivian announces delay in Georgia plant

In the winter quarter, Rivian officials announced that its grand plans for a major Georgia production facility have been put on hold, stunning Georgia economic development officials and lawmakers. Until March of this year, Rivian seemed to be near breaking ground on the plant, which, again, represents a $5 billion investment involving 7,500 jobs and 400,000 electric SUV units produced each year. At the time of the announcement in late 2021, the Rivian deal was the largest in Georgia history.

Yet, should we be surprised when one or more OEMs put on hold billions in investments or even fail completely in what is essentially the “fourth year of a 110-year-old industry” as it just gets started?

Alan Amici, the CEO of the Ann Arbor, Mich.-based Center for Automotive Research, said just that at our Southern Economic Development Roundtable in January (SEDR@ThePearl@RosemaryBeach).

I found Amici’s statement, “We are in the fourth year of a 110-year-old industry” so profound. (Amici will also attend our Southern Automotive Corridor Economic Development Summit in Greenville, S.C., August 15-17, 2024 at the Grand Bohemian Lodge if you would like to meet and hear him. If you would like to receive an invite, please let me know.)

I liken this surge — and that it is — in EV competition and investments to the banking crisis from 2007 to 2009. Some of the banks failed. Some were purchased and their names are gone forever. And then some strived and thrived.

How is the one of the world’s newest industries also one of the world’s largest (based on investment) not a crap shoot when the automotive industry has essentially done it the same way for 100 years any different?

Yes, there will be losers, but there also will be big winners.

ALABAMA

ALABAMAAlabama claims No. 1 spot last year for auto-exporting states for the first time

Alabama has become the nation’s No. 1 auto-exporting state, with international vehicle shipments surging past $11.2 billion in 2023 to overtake long-time leader South Carolina, according to new trade data.

Alabama’s auto exports have climbed 45 percent in value since 2021, when they totaled $7.7 billion, according to figures from the Alabama Department of Commerce. “Alabama’s auto industry has become an exporting powerhouse, with vehicles produced in the state finding markets around the world,” said Ellen McNair, secretary of the Alabama Department of Commerce.

While Alabama’s auto exports have been climbing, South Carolina’s have remained steady at just over $10 billion a year since 2021, according to the data. Other top auto-exporting states include Michigan, California and Texas.

Alabama auto exports landed in 78 countries in 2023, with major trading partners Germany, China and Canada being the leading destinations, according to Commerce data.

Toyota begins production on new engine line in Huntsville

Toyota Alabama announced that it has begun production of its i-FORCE 2.4-liter turbo engine line at its Huntsville engine plant, culminating a $222 million corporate investment in the project. The 2,000-employee plant will provide powertrains for the new Tacoma pickup.

Hyundai supplier to create 200 jobs in Georgia

Doowon Climate Control America will build a new plant near Metter in Candler County, Ga. The $30 million investment will create 200 new jobs. Gov. Brian Kemp said that Georgia’s expanding EV industry is benefiting rural corners of the state. “In fiscal year 2023, alone, 82 percent of new jobs created and more than $20 billion of investments went to communities outside the metro Atlanta area,” Kemp said in a news release.

Imola Automotive USA establishing a plant in Fort Valley

The Italian electric car manufacturer will break ground in the third quarter of 2024, eventually employing 7,500.

Toyota boosts investment to $1.3 billion for Kentucky battery production

The automotive leader announced the investment in its flagship Toyota Motor Manufacturing, Kentucky (TMMK) facility in Georgetown, cementing its commitment to being a long-term employer and establishing the automotive plant as a central part of Toyota’s electrification strategy. The company plans on producing an all-new, three-row battery electric SUV. With a total investment of $10 billion, TMMK is Toyota’s largest production facility globally, having produced 12 million vehicles including the Camry, America’s best-selling sedan.

Life for Tyres Group Limited announces $46 million tire recycling facility in Louisiana

Europe’s largest end-of-stage tire recycling company will establish its first U.S. processing facility at the Port of South Louisiana, creating 46 direct new jobs in St. John the Baptist Parish.

Cummins, Daimler Truck and Paccar to build $1.9 billion battery facility in Marshall County

The tri-venture will bring 2,000 jobs to the Chickasaw Trails Industrial Park in Byhalia, Miss. The operation will produce batteries for medium- and heavy-duty commercial electric trucks.

Fujihatsu & Toyotsu Battery Components, North Carolina to invest $60 million near Toyota plant in Randolph County

The venture will produce prismatic aluminum cell cases and cell covers with discharge values. The Toyota supplier will create 133 jobs.

SOUTH CAROLINA

SOUTH CAROLINAScout Motors to be revived in South Carolina

We are seeing startups and reboots of models not assembled in decades as automakers make a beeline to electrification. Recently announced, the old Scout brand that was built by International Harvester decades ago (and which many consider the first SUV) is being revived. Volkswagen and others have invested in Scout Motors and plan a $2 billion factory capable of making up to 200,000 of the iconic vehicles in South Carolina. Reports state that Scout Motors will build its factory in Blythewood about 20 miles north of Columbia, which will ultimately employ 4,000 people on 1,600 acres right in the middle of the developing “battery belt.” The plant itself will occupy 1,100 acres of that property.

AESC is spending over $3 billion in South Carolina

AESC, a world-leading battery technology company, announced the expansion of its lithium-ion electric vehicle battery manufacturing operations in Florence County, S.C. The company’s $1.5 billion investment will create 1,080 new jobs. This investment follows AESC’s initial announcement in December 2022, and expansion announcement in December 2023, resulting in a total investment of $3.12 billion and supporting 2,700 new jobs across the local community.

In 2022, the company announced a multi-year partnership with BMW to supply technology-leading battery cells to be used in the next-

generation electric vehicle models produced at Plant Spartanburg. AESC’s latest expansion will extend the partnership to additionally provide electric vehicle battery components for BMW Group’s Mexico Assembly Operations.

Tesla to establish first South Carolina facility in Greenville County

The electric car company plans to lease 251,100 square feet to create a regional parts distribution facility.

TENNESSEE

TENNESSEEProgress at Ford’s BlueOval City near Memphis

Work on West Tennessee’s BlueOval City is entering a new phase.

Last year, Ford hit peak construction employment in Q3 2023, matching the timing given years ago when Ford first came to town. In fact, when plant manager Kel Kearns first gave that timeline, BlueOval City was still an empty field.

Months later, it was an active construction site about 50 percent complete — with plenty of mud still around — when Ford CEO Jim Farley visited in March 2023. The company has spent billions on construction and supplies, and is now entering the installation phase.

As of April, machinery is being installed in BlueOval City’s paint shop, vehicle assembly and stamping areas. That means work now moves inside the massive facilities on campus, with literal tons of equipment installed in a way that has been planned for months to ensure top-level efficiency.

Now, as the campus begins installing machines and new workers arrive, Ford will begin producing trucks to be delivered to customers in 2026.

Ford doubling down on EVs, hybrids as BlueOval City’s T3 gets release window

Ford Motor Co. announced that it is embracing electric vehicles (EVs) and hybrid vehicles for its Ford Blue division. By the end of the decade, it plans to offer hybrid powertrains on every model.

LG Chem signs $19 billion deal with GM

With construction of LG Chem’s $3.2 billion factory in Clarksville, the largest foreign investment in Tennessee history, the South Korean battery maker has agreed to provide GM with battery materials able to power 5 million all-electric vehicles with a 300-mile range.

Elon Musk wants to move Tesla, SpaceX incorporation to Texas

The Tesla, SpaceX and X chief executive said the company will hold a shareholder vote to decide whether to incorporate in the Lone Star State.

Tesla to occupy 1 million square feet in Kyle, Texas

EV automaker and Austin-headquartered Tesla is moving forward with a warehouse and light assembly facility in Kyle. No word on jobs.

Norwegian EV parts supplier set to spend millions, hire hundreds in Mesquite, Texas

Hexagon Purus ASA, which makes batteries and systems for electric vehicles, is moving into existing facilities in Mesquite. The project will create 250 jobs.

Vehicle parts manufacturer for Tesla to open plant in Austin metro

US Farathane, parts supplier to Tesla’s Austin factory, announced in the winter it will open a plant in North Austin. The project will create 100 jobs.

Global automotive parts supplier to invest $100 million north of Austin

Hanwha Advanced Materials, a massive global automotive parts supplier, is investing $100 million and hiring hundreds as it sets up shop in Williamson County, north of Austin. The company will build its new plant in Georgetown.