Well, it took 23 years, and 30 years or more of planning and strategizing, but it finally happened. Last year, for the first time in the South’s history and for the first time in our annual SB&D 100 ranking, the automotive and aerospace industries ranked No. 1 and No. 2 in the South for the most large manufacturing projects announced meeting or exceeding 200 jobs and/or $30 million in investment.

It is truly a major accomplishment. For about three decades now, state and local governments in the American South have positioned themselves to become outstanding locations for both the aerospace and automotive industries. In fact, many of the projects announced in the region today — advanced metals, coatings and component manufacturers — supply both industries.

It is truly a major accomplishment. For about three decades now, state and local governments in the American South have positioned themselves to become outstanding locations for both the aerospace and automotive industries. In fact, many of the projects announced in the region today — advanced metals, coatings and component manufacturers — supply both industries.

Some huge aerospace and automotive wins for the South

The fact that the South has captured two of the three full assembly airliner facilities operating in the United States — Boeing in North Charleston, S.C. (2009) and Airbus in Mobile, Ala. (2012) — and 12 major automotive assembly plants in the last 25 years is simply astounding. Those accomplishments have established the American South as a huge player in the manufacturing sector on a worldwide scale, and the most popular destination in North America for large domestic and foreign direct investment projects.

Just in wages alone, you can easily see why economic development is so important to a community or a state, particularly with large projects of this sort. The fact that every one of the listed projects has annual payrolls of hundreds of millions of dollars illustrates the true return on investment of Big Kahuna projects like those found in aerospace and automotive. In one year, projects like these can generate as much in payroll as they have received from their entire incentive packages, totally discrediting the argument of “corporate welfare.” Just one of these projects can single-handedly transform the economic course of a community or even a state’s economy.

Just in wages alone, you can easily see why economic development is so important to a community or a state, particularly with large projects of this sort. The fact that every one of the listed projects has annual payrolls of hundreds of millions of dollars illustrates the true return on investment of Big Kahuna projects like those found in aerospace and automotive. In one year, projects like these can generate as much in payroll as they have received from their entire incentive packages, totally discrediting the argument of “corporate welfare.” Just one of these projects can single-handedly transform the economic course of a community or even a state’s economy.

What’s more, payroll totals are from single-site facilities only, and do not include payroll or direct employment from off-site suppliers or indirect employment or payroll from other employers supporting the project. For example, the estimated annual payroll at the BMW plant in Spartanburg County, S.C., is right at $712 million. However, you can add an estimated $1 billion in payroll annually from companies that supply the BMW plant with parts and other materials from South Carolina facilities and facilities in several other states and countries.

It’s almost hard to grasp the payroll totals some of these automotive and aerospace plants produce each year. It should be noted that according to the Aerospace Industries Association, the average worker in the aerospace industry in the U.S. makes $93,000 a year including benefits. In comparison, according to Autoexpress, the average worker at automotive plants in the U.S. earns $77,000 a year, including benefits. There are exceptions, of course. If you are lucky enough to work at the Mercedes-Benz factory in Alabama, you will earn on average $65 per hour, according to the Center for Automotive Research. That is well over $100,000 per year in wages alone.

It’s almost hard to grasp the payroll totals some of these automotive and aerospace plants produce each year. It should be noted that according to the Aerospace Industries Association, the average worker in the aerospace industry in the U.S. makes $93,000 a year including benefits. In comparison, according to Autoexpress, the average worker at automotive plants in the U.S. earns $77,000 a year, including benefits. There are exceptions, of course. If you are lucky enough to work at the Mercedes-Benz factory in Alabama, you will earn on average $65 per hour, according to the Center for Automotive Research. That is well over $100,000 per year in wages alone.

Combined, the aerospace and automotive industries in the South are a behemoth. Together, they make up a massive part of the South’s economy, which, with a gross regional product of $6.3 trillion last year, dwarfs the economies of the other three U.S. regions. For example, the gross regional product of the West is in second place among the four U.S. regions with $4.8 trillion in gross product last year. At this rate of growth, within five years, the South’s economy will be double that of the Midwest, which produced $3.5 trillion worth of goods and services last year.

The automotive and aerospace industries in the South are the largest generator of GDP and exports in the region, and the economic base they have provided is the envy of the world. There is no place globally where automotive and aerospace industries are more productive than in the American South.

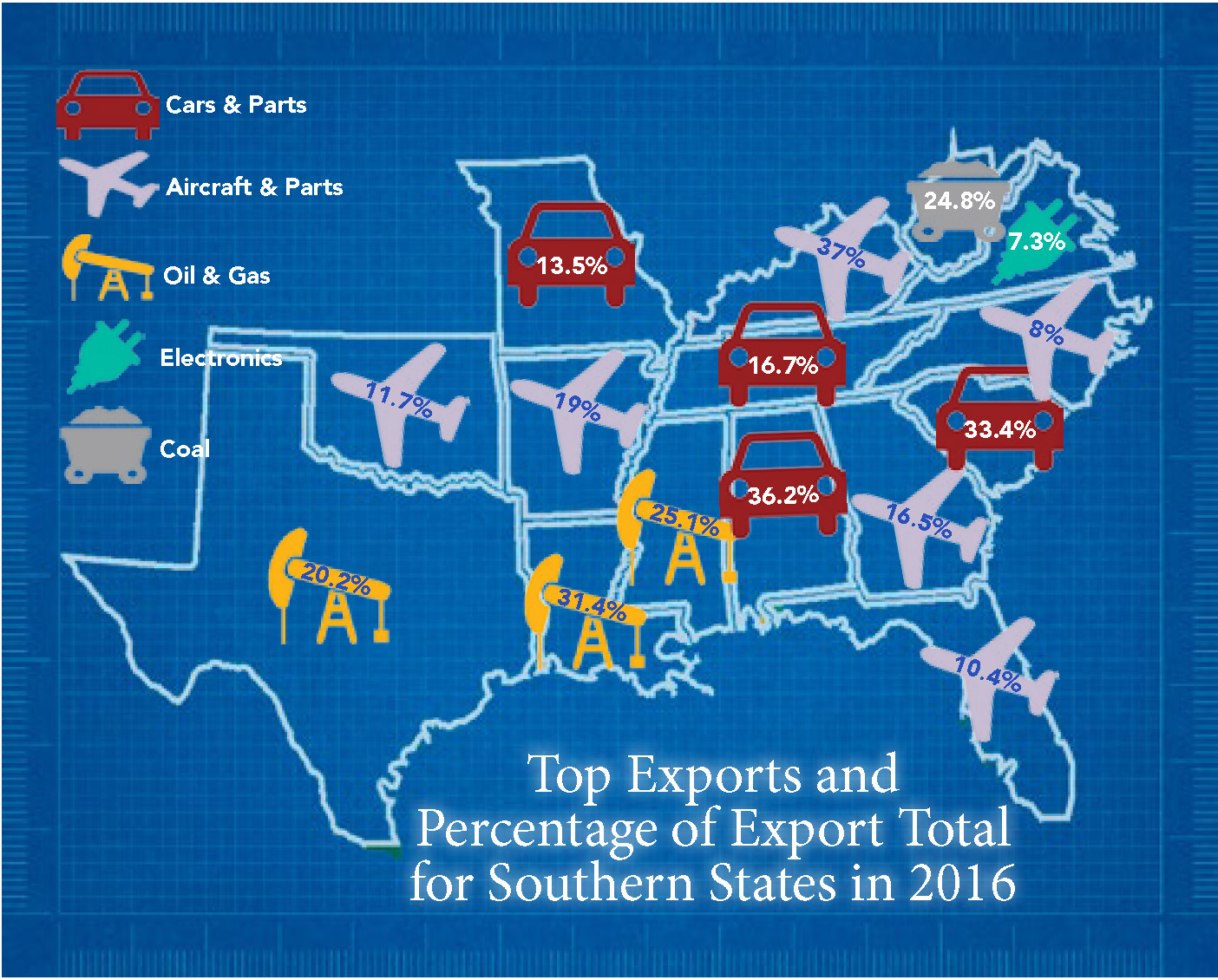

For example, of the 15 states in the South, 10 have either automotive or aerospace as their largest exports. Even more, six states in the South have automotive and/or aerospace as No. 1 and No. 2 at the top of their export industry sectors. Those states are Alabama, Georgia, Kentucky, Missouri, South Carolina and Tennessee.

While the automotive industry consistently turns the most projects in the South, the aviation and aerospace sector set records in 2016 for the most large projects announced. With 55 projects of 200 jobs or more, aerospace nearly doubled its previous record total of large projects announced in the region.

The aerospace industry in the South

In an article published by the Pew Charitable Trusts in 2014 titled, “Aerospace Manufacturing Takes Off in Southern States,” author Pamela Prah wrote, “Aerospace companies are taking a cue from the auto industry and moving their manufacturing operations to Southern states. The region’s lower costs, generous state incentive packages and right to work laws that make it hard for unions to organize are motivating these companies to choose the South.”

In 2016, the aerospace industry in the U.S. exported (including aircraft, engines, parts and spacecraft) a record $146 billion, a figure that is up 52 percent over the past five years. The U.S. aerospace industry continues to lead all other industries in net exports of manufactured goods. Aerospace exports enjoyed a favorable trade balance in 2016 of a net-plus of $90 billion, the highest value of export to import of any U.S. manufacturing sector. That means when it comes to the aerospace industry, business is being done for the most part on American terms on a global basis. Fundamentally, the U.S. is the center of the world’s aerospace universe.

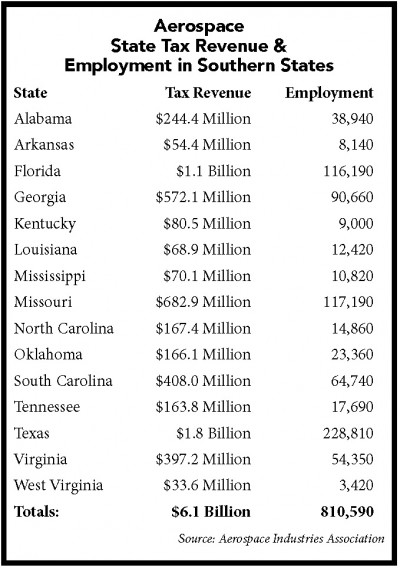

Of the $146 billion in aerospace exports last year, the 15-state American South saw export values of $42 billion, or about 30 percent of the nation’s total.

Approximately 2.4 million people work in the aviation and aerospace industry in the U.S., with 810,590 of those working in the American South, or 34 percent of the nation’s total. The U.S. South is second to the U.S. West region in total regional aerospace employment. In the West, where Boeing has its largest facilities, 1,251,000 people work in aerospace, meaning that over 2 million of the 2.4 million working in the industry are located in the South and the West. So, essentially, almost the entire aerospace industry is located in the Southern and Western regions of the country.

|

| Bell Helicopter is pitching its in-development 525 Relentless to military customers as a 20-passenger troop transport or search and rescue (SAR) platform. Bell is headquartered in Fort Worth and has a new assembly facility in Lafayette, La. Another facility is located in Amarillo, Texas. |

Just about everything in aviation and aerospace is built in the American South, from commercial and general aviation, military aircraft, missiles and space systems. Here are some highlights:

Boeing

Boeing has had a significant presence in Alabama for more than 50 years, participating in key NASA and defense programs.

Boeing fully assembles the 787 Dreamliner at its facilities in North Charleston, S.C.

Boeing Space has extensive operations on Florida’s Space Coast and throughout much of the state of Florida.

Boeing has substantial operations in the St. Louis region. Approximately 15,000 people are employed by Boeing in St. Louis, Mo., making everything from military aircraft to missiles.

Boeing has other major operations in Oklahoma, Texas and Virginia.

Airbus

The Airbus production center in Mobile, Ala., is one of only three commercial final assembly airliner facilities in the United States. The other two are Boeing’s facilities near Seattle and its North Charleston, S.C., Dreamliner facility.

Airbus operates other facilities in Mississippi and Texas, and its North American headquarters is located in McNair, Va.

Delta Airlines

Headquartered in Atlanta where it operates its largest hub, Delta is Georgia’s No. 1 private employer with 33,000 employees statewide. The airline also operates its largest maintenance operation in Atlanta.

American Airlines

AA operates its headquarters in Fort Worth, Texas, and the American Airlines Maintenance and Engineering Center in Tulsa is the largest commercial MRO facility in the world. The largest military MRO in the world is also located in Oklahoma.

Southwest Airlines

In its 47th year of service, Southwest Airlines is headquartered in Dallas, and the airline employs more than 55,000 workers.

Gulfstream

Gulfstream has a large full assembly operation in Savannah, Ga., for its corporate jets where it employs over 9,000. It also has facilities in Florida and Texas.

Honda Aircraft

Honda Aircraft fully assembles its corporate jets in Greensboro, N.C.

Spirit AeroSystems

The maker of large aerostructures has significant operations in Oklahoma and North Carolina.

NASA

NASA’s Marshall Space Flight Center in Huntsville, Ala., which developed the Saturn V rocket, is now designing the propulsion systems for the Space Launch System, the largest rocket ever built.

NASA operates large facilities at Michoud Assembly Facility in New Orleans that produces large core stages for the new Space Launch System, and at the Stennis Space Center in Mississippi.

NASA also has other facilities in Florida, Texas and Virginia.

|

| A billowing plume of steam signals a successful 450-second test of the RS-25 rocket engine at NASA’s Stennis Space Center near Bay St. Louis, Miss. It is one of the engines for the Space Launch System (SLS) rocket that will send astronauts to deep-space destinations, including Mars. |

United Launch Alliance

ULA’s facility in Decatur, Ala., is the sole production source of the powerful Atlas V and Delta IV rockets that put satellites into orbit. It also operates in Harlingen, Texas, and its launch operation is located at Cape Canaveral Air Force Station on Florida’s Space Coast.

GE Aviation

GE Aviation operates large plants in Madisonville, Ky.; Durham, N.C.; Jacksonville, Fla.; Auburn, Ala.; Batesville, Miss.; Wilmington, N.C.; and Dallas.

Northrop Grumman

Much of Northrop’s defense industry business is done in Central Florida, notably in Melbourne and St. Augustine. Northrop’s headquarters is in Falls Church, Va. It also has a major presence in St. Louis.

Lockheed Martin

Lockheed Martin employs nearly 9,000 people in Central Florida, with operations centered on defense and space flight.

Lockheed Martin Aeronautics is headquartered in Fort Worth, Texas, where it employs thousands that fully assemble the F-35 there.

The C-130J Hercules and the F-22 Raptor are assembled by Lockheed at its facilities in Marietta, Ga. The company also makes components for the F-35 in Marietta.

Lockheed Martin operates other facilities in Alabama, Arkansas, Florida, Kentucky, Louisiana, Mississippi, South Carolina, Texas, Virginia and West Virginia.

Embraer

Embraer’s North American headquarters is in South Florida, and it makes its executive jets in Melbourne, Fla.

Cirrus Aircraft

Cirrus operates its Vision Center in Knoxville, Tenn., where every Cirrus jet is delivered.

Rolls-Royce

The British aerospace giant makes engine components in Prince George, Va., and its North American headquarters is in Reston, Va.

Dassault Falcon Jet

Dassault Falcon completes its jets at the Bill & Hillary Clinton International Airport in Little Rock, Ark., where it employs about 1,800 people.

Bell Helicopter

Bell is headquartered in Fort Worth and has a new assembly facility in Lafayette, La. Another facility is located in Amarillo, Texas

UTC Aerospace Systems

UTC is headquartered in Charlotte and operates facilities in Monroe and Raleigh, N.C., Alabama, Florida, Kentucky, South Carolina, Tennessee, Texas and West Virginia.

SpaceX

Elon Musk’s Space X is now the most active space company in the world, launching frequently from Kennedy Space Center in Brevard County, Fla. SpaceX has also built a launch site in Boca Chica Village, Texas, near Brownsville. The company is expected to launch its first rockets from the Texas site next year.

Blue Origin

Jeff Bezos’ Blue Origin is building a 750,000-square-foot facility at Kennedy Space Center’s Exploration Park, where it will assemble its massive New Glenn rockets. The company will soon be building the BE-4 engines that will launch those rockets at a new plant in Huntsville, Ala.

UPS

Atlanta-based UPS operates its largest air freight hub in Louisville, where its 5.2-million-square-foot facility houses over 20,000 employees.

|

| Atlanta-based UPS operates its largest air freight hub in Louisville, Ky., where its 5.2-million-square-foot facility houses over 20,000 employees. |

FedEx

FedEx has its largest air freight hub in Memphis, where it employs about 12,000 workers. The Memphis-based company employs over 30,000 in the Memphis region.

Amazon

Earlier this year, online retail giant Amazon chose the Cincinnati/Northern Kentucky airport, which is located in Kentucky, for a $1.49 billion, 2,700-job worldwide cargo hub.

In looking at this chart, the export value and percentages of export totals are strikingly similar between the aerospace industry and the automotive industry in the South. The value of aerospace exports in 2016 in the South totaled $42 billion and its percentage of total exports was at 9.7 percent. As for automotive exports in the South, the total was at $39.4 billion in 2016 and vehicles and parts represented 9.3 percent of all exports.

Combined, companies in the South exported nearly $81 billion in aircraft, aerospace parts, passenger vehicles and automotive parts in calendar year 2016. Even more, nearly 20 percent of all exports from the American South last year were automotive and aerospace products. No other two industries in the region can make that claim.

The automotive industry in the South

|

| Nissan was the beginning of advanced automotive manufacturing prospects inMississippi when it established its assembly plant in Canton in 2003. Production of the company’s full-size truck, the Titan, began in September of that year. The first generation Titan continued without a major redesign through 2015. |

To give you an idea of how strong the automotive industry is in the South, check this out: even in a year when we saw the first significant layoffs in automotive since 2010, the sector still outperformed every other service and manufacturing category in the region in 2016. Automotive has led all sectors in the number of large projects announced in the South 22 out of the last 23 years. The only sector to total more projects was call centers in 1998.

In calendar year 2015, automotive led all categories by a wide margin with 111 big deals. That total fell to 85 in 2016, but it still accounted for almost one-quarter of the 353 manufacturing projects that were announced in 2016 meeting or exceeding our large project criteria. The largest automotive project in 2016 was Continental Tire’s 2,500-employee, $1.4 billion plant in Clinton, Miss. (featured on the cover of this issue). Other large projects announced last year were GM expanding its plant in Spring Hill, Tenn., Sentury Tire’s greenfield facility in Troup County, Ga., and GM’s expansion in Bowling Green, Ky.

Automakers sold a record 17.55 million vehicles in calendar year 2016, beating 2015’s previous record of 17.47 million units, according to industry tracking firm Autodata. Yet, so far this year, sales have been choppy, with total light vehicle sales down by 3 percent from last year. There were only three assembly plant expansions in the South in calendar year 2016, when there were 11 in 2015. Then again, there have been four major automotive expansions this year. Toyota announced it is investing $1.3 billion in its plant in Kentucky. Ford is investing $900 million in its truck plant in Louisville. Mercedes is investing $1 billion to build EVs in Alabama, and Volvo just announced it is investing $1 billion and adding an SUV line at its plant in Berkeley County, S.C., and that facility isn’t even open yet. So, the Southern Auto Corridor keeps humming.

Automakers sold a record 17.55 million vehicles in calendar year 2016, beating 2015’s previous record of 17.47 million units, according to industry tracking firm Autodata. Yet, so far this year, sales have been choppy, with total light vehicle sales down by 3 percent from last year. There were only three assembly plant expansions in the South in calendar year 2016, when there were 11 in 2015. Then again, there have been four major automotive expansions this year. Toyota announced it is investing $1.3 billion in its plant in Kentucky. Ford is investing $900 million in its truck plant in Louisville. Mercedes is investing $1 billion to build EVs in Alabama, and Volvo just announced it is investing $1 billion and adding an SUV line at its plant in Berkeley County, S.C., and that facility isn’t even open yet. So, the Southern Auto Corridor keeps humming.

The South is home to 20 major light vehicle assembly plants, counting Volvo’s facility that is finalizing construction in Berkeley County, S.C., and the Daimler Sprinter model van plant that is being built in nearby North Charleston, S.C. Seven of those 20 plants are domestic facilities operated by GM and Ford. The other 13 are foreign-owned facilities, including assembly plants operated by Toyota (three plants), Nissan (two plants), and Mercedes-Benz, BMW, Hyundai, Kia, Volkswagen, Volvo, Honda and Daimler operating one plant each. (There is a great map available on our SouthernAutoCorridor.com site showing the locations of the South’s major light vehicle assembly plants.)

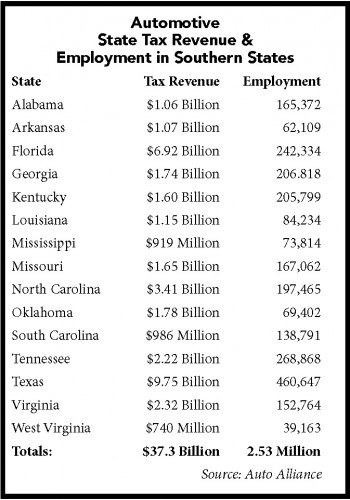

Since most aerospace sectors are not retail oriented, the 2.4 million people working in the aviation and aerospace industries in the U.S. is chump change compared to the automotive industry. There are 7.25 million jobs supported by the automotive industry in the U.S.

Automakers alone employ 2.44 million in the country, which tops the 2.4 million workers in aerospace in the U.S. Of the current total of 7.25 million people working in the automotive sector in the country, 2.53 million are in the 15-state Southern Auto Corridor, or 35 percent of the nation’s total. Only the Midwest, anchored by Michigan’s revived automotive industry, employs more automotive industry workers than the South.

In the Midwest, 2.94 million people work in the automotive industry. So like the aerospace industry, where the vast majority of people work in aerospace in the South and the West (90 percent), the vast majority (75 percent) of automotive industry employment is in the Midwest and in the South in the U.S.

Amazing turnaround by the automotive industry

|

| Nissan’s plant in Smyrna, Tenn., was the Japanese company’s first assembly plant in the United States, and is still Nissan’s largest on U.S. soil. |

More than any other industry, the automotive sector pulled the U.S. economy out of the Great Recession. We began seeing a surge in automotive production in late 2010. As assembly plants in the Southern Auto Corridor added workers, suppliers did the same, and hundreds of new suppliers were added to the mix as the industry recovered. In fact, many assembly plants took the opportunity during the low demand period in the recession to retool plants and retrain suppliers for the high demand that was sure to come.

After collapsing in 2009 with just 10.4 million units sold, the nation’s automakers saw a steady rise in sales to the record 17.46 million units sold last year. Every assembly plant but one in the South expanded at least twice, some more than three times, from 2010 to this year’s summer quarter. Several of those expansions haven’t been completed, including Toyota’s massive expansion in Kentucky and that of Mercedes-Benz in Alabama.

As mentioned, no other industry brought us out of the recession more so than automotive. This chart clearly indicates the collapse of the automotive industry in the Southern Auto Corridor during the recession and its resurgence in employment by 2015.

There is excitement among the economic development community in the South and elsewhere as Toyota and Mazda have made public a site search for a joint venture plant to build electric vehicles. Sources have reported that several states in the Southern Automotive Corridor are in the running for the $1.6 billion, 4,000-employee plant.

At this point in Toyota and Mazda’s site search, there have been reports that North Carolina has a good shot at the plant. But at this juncture, I don’t think anyone knows where the latest assembly plant will locate, and it’s certainly not a given that it will locate in the South. The last major assembly plant to locate outside the Southern Auto Corridor in the United States was a Honda facility that went to Indiana. That facility was announced in 2006. Since then, six automotive assembly plants have been built or are being built in the South.

More than automotive manufacturing

|

| A Hyundai Sonata is dipped in protective coating at the Hyundai plant in Montgomery, Ala. The $1.7 billion facility is Hyundai’s first assembly and manufacturing plant in the United States. The plant houses more than 3,000 workers. |

While the Southern Auto Corridor boasts of 30 major light vehicle and truck plants in the South and thousands of suppliers to them, one of the fastest growing components of the industry are North American headquarters. Mercedes-Benz moved its headquarters to Sandy Springs, Ga., from New Jersey in 2015. The company is finishing up its new headquarters facility in the Atlanta suburb where 1,000 people will be housed. Porsche also has a new headquarters in Atlanta.

Nissan relocated its headquarters from California to a Nashville suburb in 2008. Also that year, Volkswagen relocated its headquarters to Herndon, Va., from Auburn Hills, Mich.

But the big automotive headquarters relocation is just getting up and running in the South. Toyota announced three years ago it was relocating three facilities — two smaller operations in Kentucky and New York and its main headquarters facility in Torrance, Calif. — to Plano, Texas, a Dallas suburb. The Japanese automaker is moving about 3,000 employees and hiring 1,000 locally in the move. The project is a huge capture for North Texas. One of the chief reasons Toyota moved to Texas was housing costs... Torrance housing is double that of North Texas on average.

Conclusion

There are no industry sectors in the South that are larger than the automotive and aerospace industries when judged by GDP. The fact that so many North American headquarters in both sectors are now located in the South means that aviation, aerospace and automotive are maturing in the region and that the South is no longer the nation’s factory floor for both industries. Today, automotive and aerospace are the cornerstones of the region’s economy and will be for decades to come.