AN EXCLUSIVE FROM SOUTHERN BUSINESS & DEVELOPMENT

By Michael C. Randle

The exclusive report

SB&D is reporting that economic development project activity in the American South, the world’s third largest economy, is at the lowest mid-year point of any year since the SB&D 100 ranking was established in 1994.

Deal activity in the region so far in 2025 is slower than any period during the COVID years of 2020 and 2021, as well as all years during the Great Recession from 2007-2010. (See data and 30-plus year history of the SB&D 100 below.)

Based on raw but triple-checked data, this is the worst six-month period in the South’s modern economic development history regarding job- and investment-generating deals announced publicly by a corporation. By rule, if the deal is not publicly announced by a member of the company making the investment, it is not a deal to SB&D. It’s a dog.

These numbers are also worse than any recession I have covered since 1983. So, in short, the worst we have ever seen, even if technically the U.S. is not in recession.

And if deals are cratering like this in the South, the most desired economic development region in North America, then they are much worse in the Midwest, West and the Northeast. SB&D does not cover economic development in those U.S. regions.

Some years see the South land more large projects in the U.S. than the other three regions combined based on the various methodologies used by sources. In fact, the South’s GDP is close to matching the total GDP from the other three U.S. regions combined if you look at the latest numbers. I mean, the only two larger economies than the South’s economy in the entire world are the economies of the U.S. and China, based on GDP.

So, if we (the South) are sucking wind by dearth of deals, which we are according to the data, then the rest of the U.S. is most likely barely breathing in new job creation, better wages and capital investments that help improve the tax base. So goes the South, so goes the nation, typically, in both good and bad years.

Some rare highlights so far this year

The South has captured some big data centers this year; a handful of deals from the metals and mining sectors, and projects from energy generation and carbon capture.

And aerospace is as hot as automotive is not so far in 2025, but only from a few massive projects announced in North Carolina and Florida. I think there was a big aero deal announced in Oklahoma and one in Georgia, too, this year.

We have also seen some significant headquarter relocation projects from other U.S. regions to the South this year, including those from one Southern location to another.

Our experience has shown us several times over the decades that headquarter moves are always higher in poor economic conditions. My theory is, if a company has shut down capital investments and job generation in an effort to reduce capacity, they finally have the time to do what they might not have the time to do in a soaring economy — move their headquarters to cheaper, better locations.

It happens in every recession to the point that HQ moves in bad times are common to us. But the real fact amongst all of this is the U.S. is currently and technically not in recession.

Where have the deals gone?

For the most part you can point to one industry as the culprit. The South’s largest industry — automotive — is essentially shut down for this year and has been written off already by automakers, both domestic and foreign-owned. That could easily carry over to 2026 when the final numbers of 2025 are revealed.

To date, there have not been many major layoffs from automotive except by Nissan, and most of their closures are overseas so far. I am afraid the layoffs have not happened yet (a projection, not fact at this time) and we hope that is not the case because automotive is the South’s “Big Kahuna.”

But there is no question in our minds that automotive is headed for the weeds for a spell. It is going to happen and soon. Some major automotive brands, foreign and domestic, may not make it out of this downturn, if lengthy.

We have already seen consolidations this year as Nissan announced it will build EV batteries at a new Ford plant in Kentucky and Ford is not, as of yet. I mean what does that tell you about capacity, or lack thereof?

Automotive is far and away the South’s largest industry. We call the South’s auto industry the Southern Automotive Corridor, something I came up with in 2003 after a slew of “Big Kahunas” announced full assembly facilities in the region.

The SAC, for all practical purposes, is currently shut down and hibernating. And it won’t wake up until the economic playing field is at least partially revealed and the risks mitigated. Simply put, the risks are not worth betting against in today’s cloudy conditions.

Even more striking considering our experience, is this: low numbers from the automotive industry always are the canary in the coal mine when it comes to recessions that follow within months of the industry’s collapse. We are not saying a collapse seen in the Great Recession in automotive is imminent. We are simply reporting that the automotive sector in the South has been a no show in deals so far this year.

Automotive is always the first industry to crater in a recession and automotive is almost always the first sector to emerge to help lift us out of recessions. Take that as you will. But downturns and upturns can be judged almost exclusively by the numbers announced by the auto sector here in the South.

So far this year, there are hardly any projects coming from the automotive sector when just two and three years ago they dominated the data to the tune of hundreds of billions of dollars in EV-related investments, and the South captured the bulk of those.

Yes, the South has taken down Detroit as the future of domestic and foreign-owned automotive production in North America.

These numbers are so low that they have never before been seen

We have completed mid-year numbers for 2025. When I calculated them at the end of June, I was stunned. We always do a mid-year report on all of the projects that meet our thresholds announced in the region, but we don’t always publish them since year in and year out they typically don’t change that dramatically, certainly not like this year.

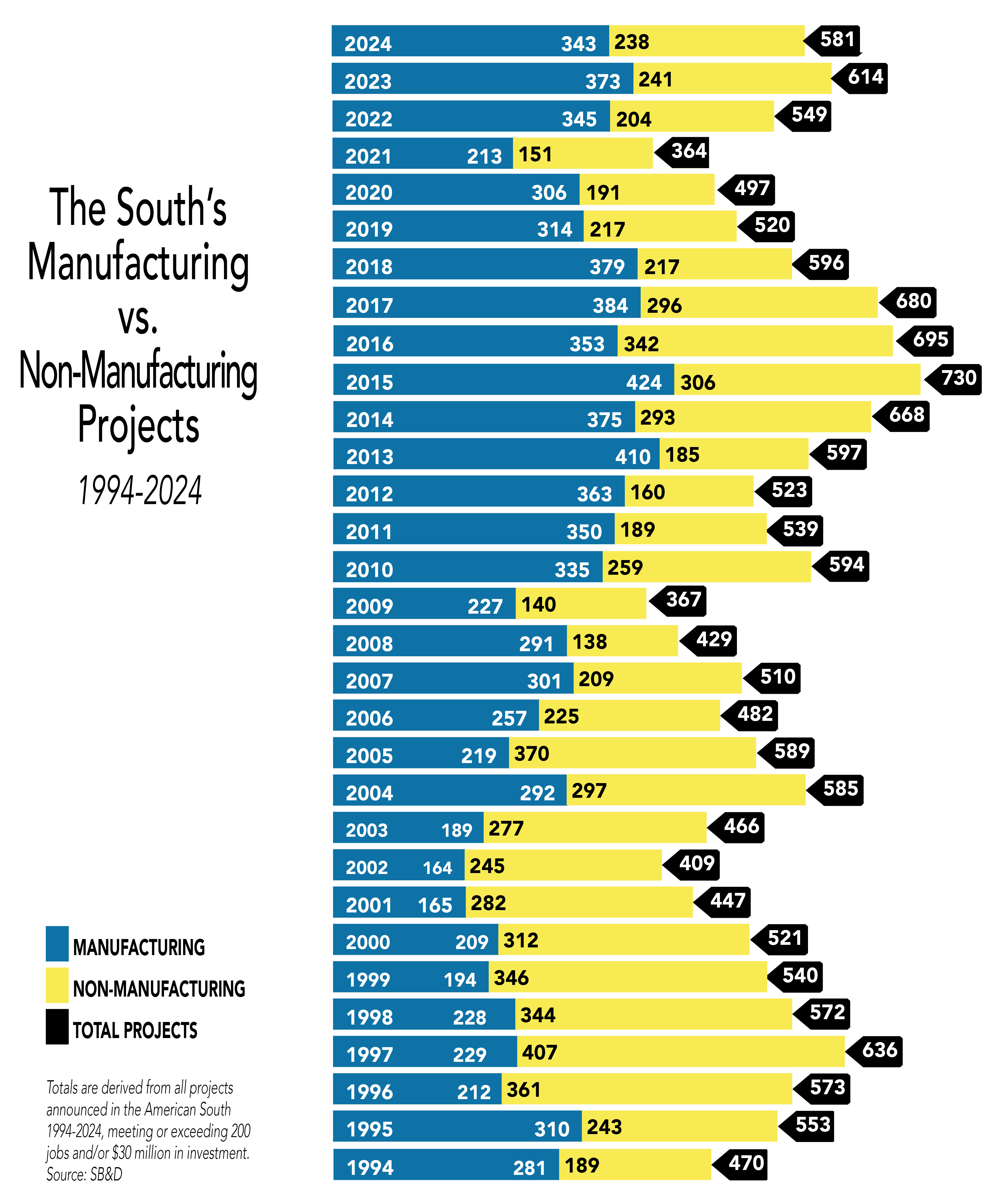

As you can see by what I call the “Big Board,” at the end of this report, you can calculate all of the SB&D 100 totals that we have broken down by manufacturing vs. service yourself. All projects meeting our thresholds are clearly outlined each year for the last 30-plus years. Call the “big board” what you want, but it is essentially a “scoreboard” of large deals announced in the region.

Our accidental discovery and reaction: “Whoa!”

In early July of this year, I counted just 137 projects announced in the South meeting or exceeding our thresholds in the first two quarters of this year. Those totals were so low that last week I injected the July numbers just to see if they could make the first two quarters look better.

That didn’t help. Adding July, or the first seven months of projects announced in South, the totals were again pathetic compared to any year since 1994 (1993 data).

In the first seven months of this year, only 171 total projects were announced in the South meeting our thresholds from January 1, 2025, to August 1, 2025.

What’s the average seven-month total over the last 30 years of the SB&D 100? It totals 318.5 projects announced in the first seven months of each year going back more than 30 years.

Therefore, after the first seven months of this year, the South is off 147.5 big job-generating deals based on an average year since 1994. That is a serious drop in deal activity, the most ever recorded.

The comparison is frightening to me and it indicates an almost total shutdown of deals in the region overall. Texas and Florida projects meeting our thresholds are way down. So are Tennessee’s and Virginia’s captures. Georgia, too. Of all the big Southern states, so far North Carolina is the only one even hanging on during this downturn.

In fact, deals are down across the board. The smaller Southern states are doing okay, landing some massive projects so far this year. Call it counter-cyclical for the smaller states like Arkansas, Louisiana, Oklahoma, Alabama, Kentucky, Mississippi and South Carolina, where at least a decent string of projects are being landed. But those smaller states are below their standards as well.

In fact, Oklahoma had its best month ever a few months ago, which of course does not make a year. And Arkansas, I remember clearly, had its best year in the “100” during the 2001 recession.

As for Kentucky and South Carolina, they have essentially bulldogged their way through this year, so they are not off by much. It is Texas, Florida and Georgia. . .those are the states that have seen the most deals simply vaporize.

More comparisons

So, let’s compare the incomplete numbers of 2025 with all years since 1994 regarding projects announced in the South. The average year-long number of deals making our SB&D 100 since 1994 is 573.4 projects of 200 jobs and/or $30 million in investment.

Right now, the South is on pace to capture just 274 projects this year. Compared to even the worst data produced in any SB&D 100, this is a shockingly low total of job- and investment-generating projects in our region.

Then again, the year is not over with five more months of data that we don’t have. I cannot predict project numbers over the next five months, but they are not expected to improve since the bulk of the tariffs just kicked in on August 1.

This lost year surely will include wide-ranging negative implications on job creation and investments; for how long, no one knows. But those are projections. The data from the first half of this year are not “projections,” they are simply a sad reality based on fact.

How does 2025 compare so far to the worst years of the SB&D 100? The two lowest project capture years in the past 30 years were in 2009 (Great Recession) with 367 deals; and in 2021 (COVID, 2020 numbers) with just 364 deals closed and posted on the big board.

In comparison, the two best years in SB&D history were in 2015 (730 projects) and 2016 (695). Again, the South is projected to land just 274 significant projects by the end of the year based on the first six month totals of 137 deals.

There were other years that saw great surges in project activity, like during the Dot-com era that began in the late 1990s. In 1997, the South captured 636 big deals, but again, many of those projects were Dot-com related. When that industry crashed prior to 2000, it would be interesting to know how many deals were actually dogs in 1997. Let’s just say it was a lot.

To date, we are not even on course to break the 300 big-project mark for the entire year, which would be a first. Furthermore, the U.S. is not in recession technically, which means this lack of investment and job generating deal list is unprecedented in that we are performing worse than during COVID or the Great Recession. Stunning!

So, what, who is the culprit, really? That’s an opinion. But it sure doesn’t help that employers do not know the rules of this economy because the rules seem to change almost daily and most of those changes are made by one man, not Congress.

So, therefore, if major employers don’t know what to expect, combined with what the true risks are, they simply sit on the sidelines. That is certainly the case so far this year based on our data.

My economist friends, who I will not name here, we have been having more discussions about this economy than any year I can remember. I guess since the Great Recession.

One of the smartest folks I know simply sent me three words on his thoughts about where the economy is in 2025. The words were, “Tick, tick, tick.” I knew exactly what that meant. All of us data-based journalism hounds do.

Obviously, it is a reference to the fact that numbers like these – since they are partial — might just be the tip of the iceberg of what is to come in their opinions.

“Tick, tick, tick,” as in waiting for the dreaded data to come in and now some of it has, including dramatically lowered (revised down) job creation numbers in the first two quarters from the U.S. Bureau of Labor Statistics.

As for me and my opinion? I have none. I only look at the numbers.

So, don’t make this report a political thingie with me or my company. It is not a politically-based report. I mean, I am just counting this sh#$ up and have for decades. It has been one of my jobs since I started this company at age 24. I am now 69.

SB&D 100’s Best Years

Year Total Projects

2015 730

2016 695

2017 680

2014 668

1997 636

Source: SB&D, Southern state economic development agencies

SB&D 100’s Worst Years

Year Total Projects

2021 364

2009 367

2002 409

2008 429

2001 447

2025* 274

*Estimated using first two 2025 quarter’s numbers of just 137 projects meeting or exceeding SB&D 100 thresholds

Source: SB&D, Southern state economic development agencies

Preview and methodology

Southern Business & Development publishes the SB&D 100 each year and has since 1994. The ranking includes all projects announced in the South that meet or exceed 200 jobs and/or $30 million in investment.

The methodology is simple in that we only count projects meeting or exceeding 200 jobs and/or $30 million in investment. And those thresholds have not changed since the inaugural 1994 SB&D 100, even though the trends for almost 20 years are higher investment numbers and lower job numbers per deal.

Using a baseball analogy, “You can’t just move the fences in or out based on emerging trends.” The rules must be consistent for accurate year-to-year results.

EDITOR’S NOTE: Data for the full year of the 2025 SB&D 100 does not come out until the winter 2026 SB&D edition.

Partial Michael Randle biography

Randle has been featured or quoted in more than 1,400 different media properties around the world and was described by Fred Barnes of Fox News as "an expert on the Southern economy."

J. Mac Holladay, a seasoned economic development practitioner and veteran of economic development in the South, said about Randle, “Michael has known, predicted and understood things in our business 10, 20 years before we did. The fact that he predicted the South would become the worldwide center of a 115-year-old automotive industry. . .I will never forget those claims because they were made by Mike more than 25 years ago.”

Michael Randle is the owner and publisher of Southern Business & Development. He may be contacted at Michael@sb-d.com.