As we monitored the South’s economy based on economic development project activity in calendar year 2019, we published things like this: “It wouldn’t surprise us if the $1.6 billion, 4,000-employee Mazda Toyota project in Huntsville, Ala., is delayed.” That quote was published in the fall 2019 issue. In the spring of 2020, Mazda and Toyota officials said the project would be delayed. Our prediction was not based on the coronavirus, it was based on automotive sales, automotive deals in the South and a slowing automotive industry in general in 2018 and 2019.

There were all kinds of red flags popping up in 2019, the basis of this report, the 27th annual SB&D 100 that counts job- and investment-generating project activity in the 15 Southern states we cover. What were some of the red flags? One, as written, was the slowdown of the automotive industry. Automotive is the South’s largest and most active industry sector and has been the No. 1 industry in projects for 25 of the last 27 years. When it slows, we notice.

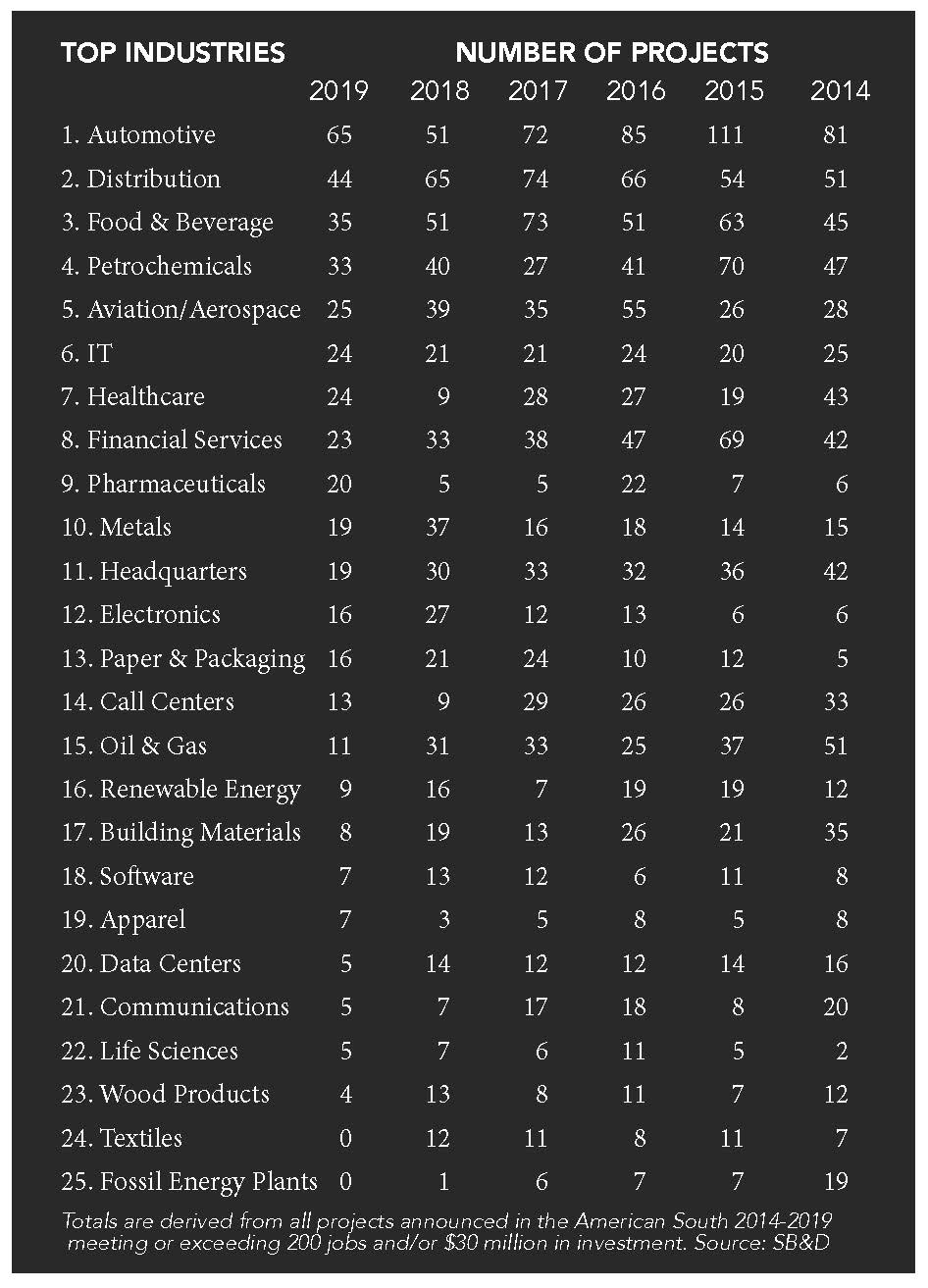

This report on 2019’s projects in the South saw a decline in automotive projects. Automotive peaked in 2015 with 111 projects meeting or exceeding our thresholds. That figured dropped to 51 projects in calendar year 2018, but rose slightly to 65 in 2019. Distribution (think Amazon) beat automotive for the top sector in deals in the South in 2018. So, that was the first red flag.

The second red flag was financial services deal activity in calendar year 2018 and 2019. Every time there was a significant drop in financial services deals over the past 27 years, a slowdown in the economy or an outright recession followed a year or two later. Financial services posted 69 big deals in 2015. In 2018, it posted 33 deals meeting or exceeding our thresholds for this ranking (200 jobs and/or $30 million in investment). Financial services dropped to just 23 deals in 2019 — one third of its total in 2015.

So, even two years ago, there was concern, based on project activity in the American South — the third largest economy in the world — that we were headed for a recession or at the least a significant downturn. Then came the coronavirus and everything just about stopped for 100 days.

I know folks want to know about the virus and how it is affecting the economy in 2020, and we will write about that some in this article. But this report is all about the previous calendar year of 2019. It’s not pretty. Here are the total deals meeting or exceeding 200 jobs and/or $30 million in investment since the SB&D 100 peaked in 2015:

|

Year |

Mfg. |

Non-Mfg. |

Total Projects |

|---|---|---|---|

| 2019 | 314 | 191 | 520 |

| 2018 | 379 | 217 | 596 |

| 2017 | 384 | 296 | 680 |

| 2016 | 353 | 342 | 695 |

| 2015 | 424 | 306 | 730 |

| 2014 | 375 | 293 | 668 |

As you can see, total job- and investment-generating projects announced have dropped every year since the peak of 2015. Tracking the SB&D 100 has shown that once the total project count drops into the 400-project range, we’re looking at recession numbers. This year’s total project total of 520 is ever so closer to the 400-range.

In 2019, the South is off 2015’s record-setting pace by over 200 deals. You can make that political if you want, but we just count this stuff up. By the totals, it is clear that in the 10-year recovery that ended this year, 2015 was the best year in terms of project activity in the South. The service industry (non-manufacturing) in 2019 collapsed just as it did in the Great Recession. Manufacturing held its own in a down year with 314 big projects. Here is project activity during the Great Recession years of 2007 to 2009:

|

Year |

Mfg. |

Non-Mfg. |

Total Projects |

|---|---|---|---|

| 2009 | 227 | 140 | 367 |

| 2008 | 291 | 138 | 429 |

| 2007 | 301 | 209 | 510 |

There are only 191 service projects meeting our thresholds in 2019, which is similar to the Great Recession. Since 2019’s numbers have nothing to do with the coronavirus recession, it is easily surmised that services were headed for recession in calendar year 2019 even without the virus. With services essentially shut down in 2020, there is no question that sector is in recession, possible depression. However, even during the coronavirus, there have been some awesome tech deals, including Microsoft’s 1,500-employee project just announced in Northern Virginia in May.

There are only 191 service projects meeting our thresholds in 2019, which is similar to the Great Recession. Since 2019’s numbers have nothing to do with the coronavirus recession, it is easily surmised that services were headed for recession in calendar year 2019 even without the virus. With services essentially shut down in 2020, there is no question that sector is in recession, possible depression. However, even during the coronavirus, there have been some awesome tech deals, including Microsoft’s 1,500-employee project just announced in Northern Virginia in May.

Services had awesome years in 2015, 2016 and 2017. Services, which employ so many more people than manufacturing, were in decline in 2019, pre-coronavirus. The sector so far in 2020 has been decimated. Restaurants, retail, entertainment, travel — everything involving lots of people in one space — is essentially snuffed out by 90 percent. However, services were in a major decline last year, too. Services depend on one thing — disposable income from those on the street. That disposable income, based on the data, was lacking pre-COVID-19. Now that we live with the virus, disposable income for many is zero with more than 40 million people unemployed. More than 80 percent of those currently unemployed worked in the service sector.

Of course, the longest recovery in U.S. history ended in the winter and spring quarters of 2019. We had achieved more than 10 years (or since the summer of 2009) of GDP growth and job growth. It all came crashing down in the winter and spring 2020 quarters. So these numbers you are reading about from last year have nothing to do with anything in 2020 such as the virus.

The similarities between the recession of 2008-2009 and 2019 are striking. Was 2019 as bad as those years of 2008 and 2009 in deal activity? No. But I guess we all know that 2020 will be as bad as the Great Recession years when this report comes out this time next year.

Were there deals out there during the first few months of the virus in the South? Yes, there were, but announcements were reduced dramatically. Thankfully, as we were finishing up this issue, announcements were already starting to pick up. A comeback is needed desperately, which may happen because the U.S. remains extremely competitive in terms of business operating costs.

I am afraid to even calculate or speculate about the first six months of this year when it comes to project activity. But that is something to ponder this time next year. The numbers won’t be pretty. Just look at this issue’s Relocations and Expansions section. It usually runs eight pages. In this issue, projects announced barely filled up five pages and they represent just about every deal announced of any significance in the South in the spring 2020 quarter.

How the SB&D 100 works

To judge the economy and how it is performing, we count the number of projects meeting or exceeding 200 jobs and/or $30 million in investment publicly announced in the South each year. We use projects submitted by each of the 15 states’ economic development agencies and back that up with announcements published on RandleReport.com. We call it the SB&D 100 in that we publish the top 100 job and top 100 investment projects announced the previous calendar year.

Ranking the markets and states that landed the most deals is easy. Depending on the size of the project, a market or state earns five or 10 points. Ten points for the largest investment and job deals, and five points for those projects that are smaller. Still, those deals must meet or exceed the thresholds of 200 jobs and/or $30 million in investment.

We count the points in each category: rural (less than 50,000 in population); small market (50,000 to 249,999); mid-market (250,000 to 749,999); major market (750,000 to 2 million) and mega-market (over 2 million in population). Based on points earned, we also rank states. However, while markets are ranked among their peer groups, on the state level, those recognized are the highest point earners based on points per million persons, or points per capita. If we did not rank states on points earned per capita, Texas would win every year based on points alone.

Companies looking to expand production — services or manufacturing —

employ experts that can see around corners. . .see what the economy will be doing in six months, a year, or three years from now, depending on how long the project will take to complete.

The 2020 SB&D 100

The 2020 SB&D 100 features 520 projects meeting or exceeding our thresholds of 200 jobs and/or $30 million in investment. It’s only the second time in six years that the total number of projects did not exceed 600 deals. It’s also the fourth consecutive year that the total number of projects has fallen from the previous year. As mentioned, the largest number of projects (730) in the history of the SB&D 100 was in 2015, and the second largest (695) number of deals meeting or exceeding our thresholds was in 2016. The total of 520 deals in calendar year 2019 is certainly no bust, but it is close. The average number of projects meeting or exceeding our thresholds over the last 15 years is 561. So, really, this year’s SB&D 100 is simply a below-average year.

So, while not a bust, the 2020 SB&D 100 is 210 projects off its record total of 730 announced in 2015 and 76 deals less than last year’s total of 596. Those are significant drops in deal activity in the South. Accordingly, we were on the downside of project activity two years ago. There were three factors that held back deals in 2019 — lack of labor, tariffs and a slowing economy. Again, these numbers have nothing to do with the virus outbreak.

Here is proof that project activity in the South or the economy at large was slowing two years ago. In 2018, layoffs hit their highest level for a first quarter in 10 years according to a report in April of that year from outplacement firm Challenger, Gary & Christmas. Of course, so far this year, layoffs have set national records.

Even though total deals in 2019 lagged again, 2018 was already telling us something. The economy was slowing beginning in 2018 and it slowed even more in project activity in 2019. It is hard to tell if project activity was slowing because of a lack of labor, the tariff war between China and the U.S. or that overall, among all sectors, the economy was slowing. I think those all go hand-in-hand, so just blame all three factors.

Again, you can blame politics for the fact that job- and investment-generating projects have dropped by more than 200 projects in 2019 since they peaked in 2015. But, there is no political affiliation with data. Data is not political. Politics is not data. Data are facts.

The 10-year recovery ends with a thud

The 10-year recovery ends with a thud

Now that the longest recovery in the nation’s history has ended after more than 10 years, we have a completed picture of that recovery from the Great Recession. Things got going in 2010 when we saw 594 projects announced that year, a major increase from the worst SB&D 100 in history in calendar year 2009. In 2009 at the height of the Great Recession, only 367 deals meeting or exceeding our thresholds were announced in the South. That year remains the lowest total of deals in 27 years of the SB&D 100.

The following three years saw project totals of 539, 523 and 597. Then in calendar year 2014, the South rang up 668 projects meeting or exceeding our thresholds. At the time, that was a record, beating the previous high total of 636 in the go-go ’90s year of 1997. By 2014, it was clear that the South had thrown off the shackles of the worst recession in our lives.

Then in 2015, magic happened. The South was landing deal after deal, setting an SB&D 100 record of 730 projects. Again, the two most important sectors in the region, automotive and financial services, posted record years with 111 deals and 69 deals respectively. Manufacturing also set a record with 424 deals. Services in 2015 also saw its deal total top 300 for the first time in 10 years.

Then in 2015, magic happened. The South was landing deal after deal, setting an SB&D 100 record of 730 projects. Again, the two most important sectors in the region, automotive and financial services, posted record years with 111 deals and 69 deals respectively. Manufacturing also set a record with 424 deals. Services in 2015 also saw its deal total top 300 for the first time in 10 years.

In 2016, the South experienced another outstanding year in economic development. Almost 700 projects (695) were announced followed by 680 in President Trump’s first year in office. Then 2018 saw the first year of projects totaling fewer than 600 (596) since 2014. And, of course, this year saw that drop to 520 deals meeting or exceeding 200 jobs and/or $30 million in investment.

The breakdown of the 2020 SB&D 100

The breakdown of the 2020 SB&D 100

One issue of concern with the 2020 SB&D 100 is that of the 520 projects that made the cut, many will be delayed or scrapped altogether as a result of the sudden halt to the economy because of COVID-19. The top job deal for 2019 was Uber, which announced a regional headquarters in Dallas in August. The deal promised 3,000 jobs.

Then, shortly after the virus caught hold in the U.S., officials with the ride-sharing giant said they would delay construction on two buildings in Dallas’ Deep Ellum district until 2021. “As a consequence of the current COVID-19 crisis, we are going to temporarily pause some construction in Dallas until 2021,” a spokesperson for the company said in a statement that was published by Bisnow.com. “In the long-term, we don’t anticipate any changes to our strategy or expectations regarding growth in the state.” I believe statements like this are an uncertainty at this point. Who knows what life and work will look like in 2021?

Smile Direct Club, the second largest job-generating deal announced in the South in 2019, is also challenged due to the virus. The company announced it was adding 2,000 jobs at its headquarters in Nashville. In March, Smile Direct Club, which sells and manufactures teeth-straightening aligners, closed all of its 350 retail locations worldwide except its Hong Kong stores. The company said in March it will continue to pay employees their regular pay. Smile Direct Club is one of Tennessee’s largest employers.

Smile Direct Club, the second largest job-generating deal announced in the South in 2019, is also challenged due to the virus. The company announced it was adding 2,000 jobs at its headquarters in Nashville. In March, Smile Direct Club, which sells and manufactures teeth-straightening aligners, closed all of its 350 retail locations worldwide except its Hong Kong stores. The company said in March it will continue to pay employees their regular pay. Smile Direct Club is one of Tennessee’s largest employers.

For the 25th year in 27 years, automotive found its rightful place at the top of the 2020 SB&D 100 with 65 projects. Distribution over the past two years was the most active industry in deal announcements in the South with 65 projects in 2018 and 74 in 2017. Amazon has had a lot to do with distribution’s incredible increase in projects. There were four this year meeting our threshold, and for Amazon, that’s a bad year. Distribution came in second this year with 44 deals.

Just about every other industry sector saw projects decline from the previous year. Automotive increased its total from 51 projects to 65, helped greatly by the state of Alabama with 27 deals. Other industry sectors that were humming in 2015 and 2016 such as aerospace, petrochemicals, food and beverage, financial services, metals, headquarters, electronics, building materials, oil and gas, data centers and wood products all had down years, some posting less than half of their totals from the peaks of 2015 and 2016.

The only sectors that saw a major increase in projects from the previous year were pharmaceuticals, healthcare and the aforementioned automotive industry. And for the first time ever, there were no textile or fossil fuel energy plants making the list.

You can always recognize a growing economy by looking at deal totals from these sectors: building materials, automotive, financial services, petrochemicals, oil and gas, and call centers. You might think food and beverage would be a growth indicator based on projects, but it really isn’t. That sector, for the most part, is recession proof.

You can always recognize a growing economy by looking at deal totals from these sectors: building materials, automotive, financial services, petrochemicals, oil and gas, and call centers. You might think food and beverage would be a growth indicator based on projects, but it really isn’t. That sector, for the most part, is recession proof.

Of those growth sectors, automotive recovered in 2019, financial services is just one third in total project activity from its peak in 2015 and petrochemicals are flat. Oil and gas has cratered and that was last year, not this year. As for call centers they are also one third off their highs from just a few years ago.